When you suffer a work-related injury, you may require ongoing medical care that will continue to be necessary, even after you’ve settled your workers’ compensation claim. In some cases, this need for ongoing treatment may even last for the rest of your life.

Workers’ compensation insurance is supposed to provide you with payment of medical bills, but when the bills are going to continue on an indefinite basis, it becomes very complicated to make sure that you do not get hit with huge and unexpected costs after your settlement is finalized.

At the end of a workers’ compensation claim where future medical costs are expected due to lifelong injuries, there are a few options on how those future medical bills will be handled. They can either choose to Leave Future Medical Open, use a “clincher” agreement to pay a lump sum upfront or create a Medicare set-aside to handle future medical costs. Read on to understand the pros and cons of these options and how to best protect your right to coverage of future medical costs that resulted from your work injury.

Talk With Our Workers’ Compensation Lawyers Today

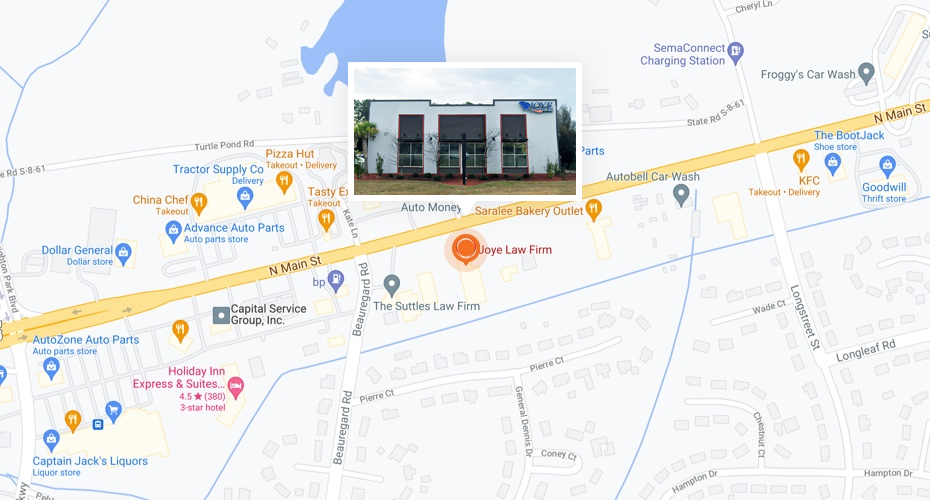

Our South Carolina workers’ compensation lawyers at Joye Law Firm represent clients throughout South Carolina who have suffered work injuries and who will need ongoing medical care. Since 1968, we have helped clients who have experienced work injuries. To learn how we can help you, contact one of our South Carolina workers’ compensation lawyers today.

Since 1968, we have helped clients regain their lives after work injuries. To learn how we can help you, contact one of our South Carolina workers’ compensation lawyers today.

You can reach us at (888)-324-3100 or fill out our online form for a free consultation.

Our firm assists clients in negotiating settlements for future medical care. We can help explain the differences between a settlement with Open Future Medical or with Medicare set-aside arrangements. We assist clients in requesting hearings in front of the South Carolina Workers’ Compensation Commission in order to be awarded ongoing medical coverage.

Understanding Medicare Set-Asides and Workers’ Compensation Benefits

Traditionally, when a workers’ compensation insurance company settled a claim with an injured worker who was disabled, they would often pay a small amount for future medical expenses with the expectation that future treatment would be covered by Medicare. Medicare is a federal insurance system that provides coverage for both senior citizens and disabled Americans.

Unfortunately, assuming that Medicare is going to cover future treatment can be a big risk. First and foremost, the future of the Medicare program is uncertain. Medicare is experiencing serious financial uncertainty, and the problems with the system are likely to grow worse as baby boomers continue to age and retire.

The bottom line is that Medicare may not be around in 10 years or 20 years, at least not in the form that it is now. Even if it does continue to exist, there are no guarantees that it will cover future treatments you need for your work-related injury. Further, with a looming financial crisis, Medicare is pushing back against being forced to assume responsibility for paying for injured workers’ treatment costs and is instead aiming to put some of this responsibility back onto workers’ compensation insurers.

Due to the complications and risks involved in making assumptions about Medicare, workers’ compensation insurers have now begun the practice of setting up Medicare Set-Aside Accounts in larger workers’ compensation settlements. Essentially, to set up these accounts, the insurance company asks a life-care planner to estimate what types of Medicare-covered treatments an injured worker will need over the course of his or her lifetime and then seeks to have this projection approved by the Centers for Medicare and Medicaid Services (CMS). The insurance company will then pay the amount of money approved by CMS. However, the injured worker will be required to put this money into a special Medicare Set-Aside Account. The account is an interest-bearing account that can be used only to pay for treatment expenses incurred due to the work injury. The expenses must be paid at the same rate as Medicare would pay. Only after the money in the set-aside account has been properly spent will Medicare kick in to cover treatment for work injuries.

Everything about these set-aside accounts is very complicated. Determining future covered costs under Medicare is not an exact science. Also, there are often future treatment costs that would not be covered by Medicare, frequently referred to as “non-covered costs.” In many cases, an injured worker can receive more money to settle their future medical coverage rights if an experienced disability attorney is consulted to help. Your attorney may advise working with an independent medical examiner or life care planner to provide a different, more accurate estimate of what the covered costs will be, so a larger settlement can be obtained. Also, your attorney may advise you against settling your future medical coverage rights as it may be in your best interest to keep your workers’ compensation coverage intact. Every situation is different.

Once the Medicare Set-Aside Account has been set up, it can also be complicated to manage the account and to prove to Medicare that it has been properly exhausted. Your workers’ compensation lawyer can advise you on this process as well.