ERISA stands for the Employee Retirement Income Security Act of 1974, codified in the U.S. Code in Title 29 Chapter 18.

The purpose of ERISA is to set minimum standards for pension plans established by private employers.

ERISA does not impose any requirement on employers to create a pension plan. Instead, it regulates employers who voluntarily choose to establish a plan for employees.

Not all employers and not all pension plans are covered, but those that are must comply with the law.

Because ERISA deals with both worker rights and with tax issues, the U.S. Treasury Department and the U.S. Department of Labor are in charge of administering and overseeing various aspects of the law.

ERISA has been modified more than 40 times since its passage. ERISA now addresses not only employee pension benefits but also other types of benefits, including health insurance provided by employers. For example, the Consolidated Omnibus Budget Reconciliation Act of 1986 (COBRA) made changes to ERISA. COBRA allows people to retain employer-sponsored health insurance for a designated period after losing or leaving a job.

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) was also an addition to ERISA. This act guarantees privacy of medical records and also allows for continuing medical coverage.

ERISA’s Pension Provisions

While ERISA addresses many different employee benefits programs, the most important aspects of ERISA for most employees are the pension protections.

There are several key provisions in ERISA that ensure employees’ pensions are properly taken care of and that employees have some basic guarantees when it comes to their promised retirement benefits.

For example, ERISA:

- Establishes requirements for when employees must be permitted to become part of a pension plan. Again, employers do not have to provide a plan, but if they choose to do so, then ERISA makes sure that employees have the opportunity to join after a designated time period.

- Establishes “vesting” requirements. This means that after employees have worked for a designated period of time, they must obtain an interest in their pension that cannot be forfeited. The designated period and the vesting rules vary, depending on the pension. For example, with defined contribution plans (like a 401k), the employee’s contributions vest right away. However, if the employer matches contributions, then they do not have to vest immediately.

- Establishes rules for how long an employee can be away from his or her job before pension benefits or eligibility for a pension may be affected.

- Establishes rules on when and under what circumstances a spouse must be entitled to a portion of an employee’s pension in the event the worker dies.

- Requires employers that provide a pension plan to provide employees with certain information about their plan and benefits. The information must include details about the features of the benefit plan and the funding for the plan. While some of the required information must be available to employees free of charge, employers may be permitted to charge for other information.

- Sets mandates on funding for employer-sponsored pension plans. There are detailed funding rules that ensure that sponsors of the plan actually put enough money into the plan and keep it there so that the company’s pension obligations can be fulfilled.

- Establishes rules and regulations for those in charge of managing pension plans. The people who oversee a pension fund and manage and invest that fund are called “plan fiduciaries.”

- Defines a fiduciary as anyone who has discretionary authority or control over how a plan or its assets are invested or managed. Those who provide advice on investing are also fiduciaries. Fiduciaries have to follow ERISA guidelines, must act in the interests of securing the solvency of the plan, and cannot violate ERISA rules or they can become personally responsible for restoring any money that they caused the plan to lose.

- Provides pension beneficiaries with the legal right to sue for their benefits and to sue fiduciaries for breach of duty.

- Guarantees the payment of certain types of benefits when a defined-benefit plan is terminated or ended.

All of these important requirements are intended to make sure that money promised to employees is available.

There is a distinction between defined-contribution plans and defined-benefit plans, and ERISA protects both.

A defined-contribution plan is a plan where money is put in by the employee or the employer, but there is no guarantee of any set benefit coming out. For example, if you put money into your 401k and your employer matches and all the cash is invested in the stock of a company that goes bankrupt, there is no guarantee of getting any money out.

A defined-benefit plan, on the other hand, provides a guaranteed set benefit, such as a certain amount of monthly income once you reach retirement age and/or have worked for a designated number of years. It is this type of plan that is protected by a guarantee that certain benefits will be paid out. If your employer squanders the pension fund, goes bankrupt, or otherwise can’t pay the defined benefits as promised, then the Pension Benefit Guaranty Corporation can step in and make distributions.

Getting Legal Help With an ERISA Claim

The bottom line is that ERISA is meant to make sure you get the pension and benefits you deserve and were promised. If you don’t, ERISA gives you the right to sue, and it provides protection, in certain instances, in the event that your employer can’t pay as promised.

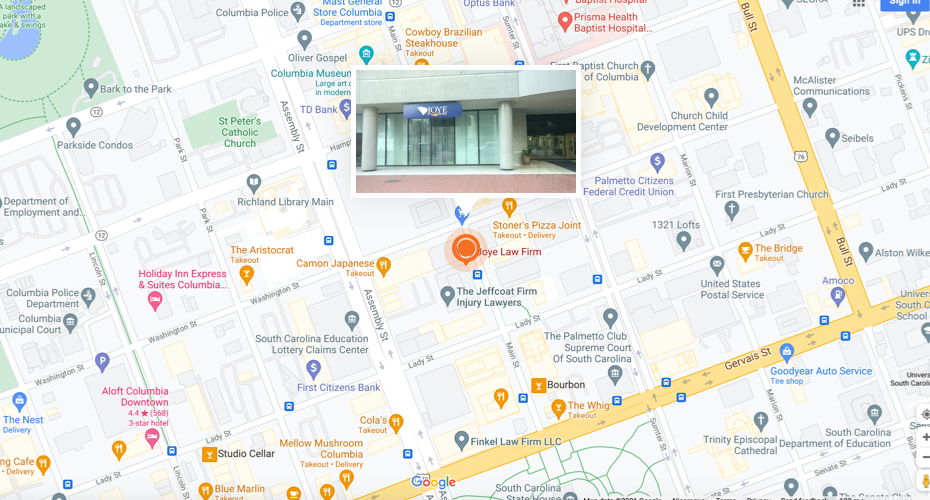

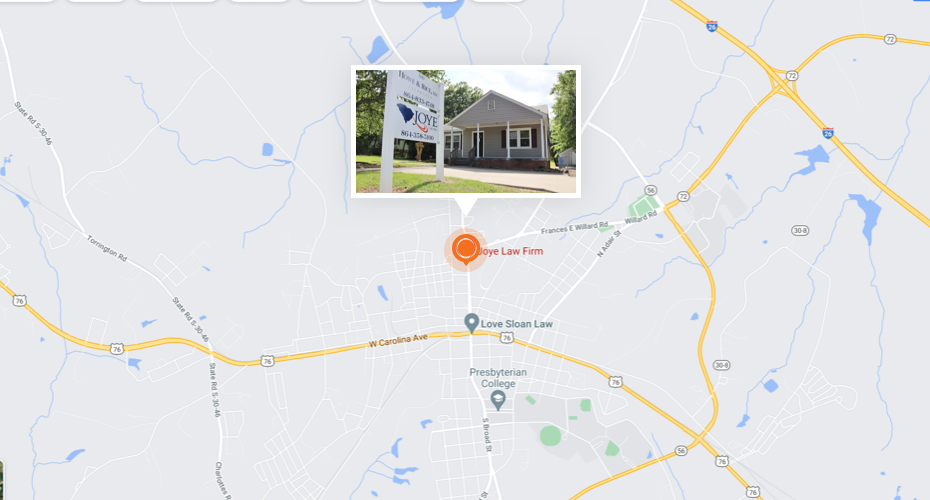

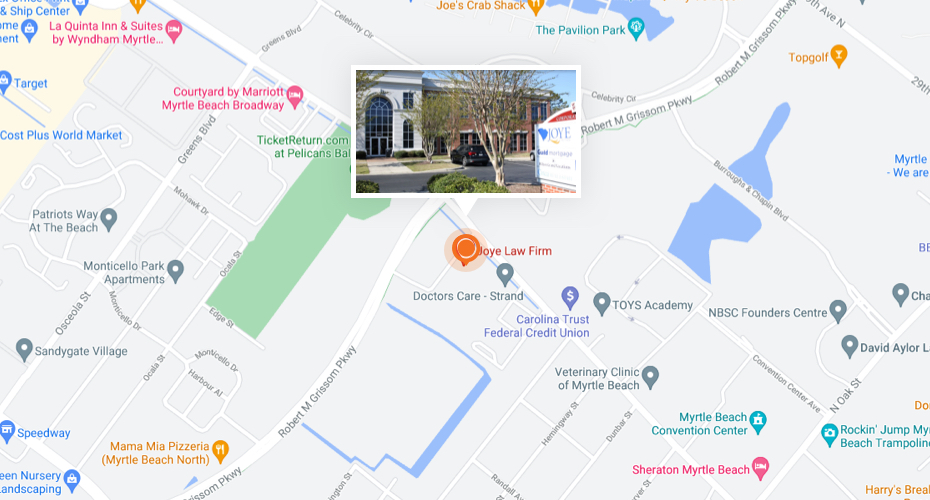

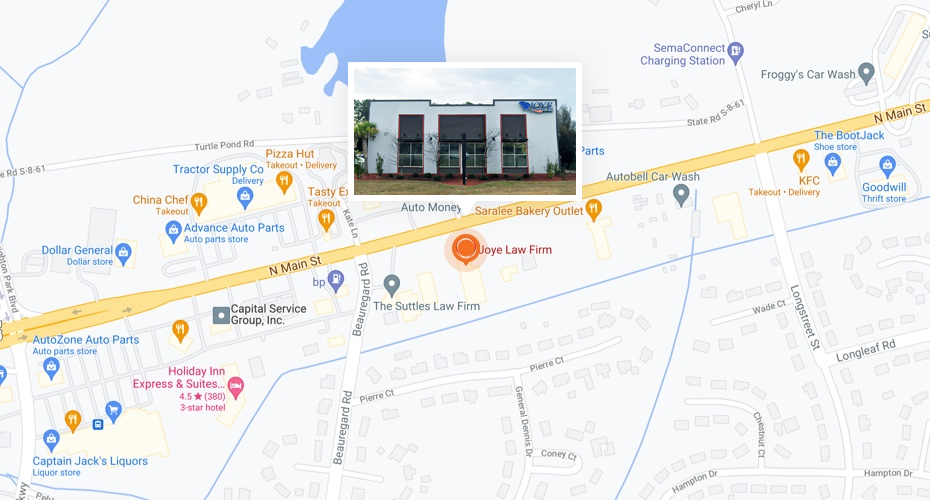

It is up to you to enforce your rights under ERISA and to take action if your employer is acting wrongfully or if your pension isn’t being paid as promised. Our South Carolina ERISA attorneys at Joye Law Firm can help to ensure you get the benefits that you earned.

Just Call Joye Law Firm

Reach us today at (888) 324-3100 or fill out our online contact form to schedule a free consultation with one of our South Carolina ERISA lawyers.