Every month, you pay your auto insurance premiums. However, when did you last review your insurance policy? Do you know what type of protection you have bought in case you get into an auto accident? Are you looking to buy insurance from a different company?

Here, we provide an overview of the different types of coverage that auto insurers provide to South Carolina drivers:

- Liability

Liability coverage protects other drivers if you damage their vehicle or cause them to suffer bodily injury in a crash. South Carolina law requires that you carry liability coverage in the following minimum amounts:- $25,000 for bodily injury to one person

- $50,000 for bodily injury to all persons in a single accident

- $25,000 for property damage.

Keep in mind: These are only the minimum amounts of coverage. You should strongly consider carrying liability insurance above these amounts.

- Uninsured Motorist

Uninsured motorist (UM) coverage protects you if you get into a crash with a driver who has no insurance, or if you are involved in a hit-and-run crash. It can cover your medical bills, lost wages, pain and suffering, and other damages. You must carry UM coverage that equals the minimum amounts you have in liability coverage. - Underinsured Motorist

Underinsured motorist (UIM) coverage protects you if you get into a crash with a driver whose insurance fails to pay for all of your damages. UIM will cover the difference between what the other driver’s insurance covers and the total amount of your damages – up to your policy’s limits. An insurance company must offer UIM to you, but you are not required to buy it. However, if you consider how high medical costs can be after an accident – and the fact that most people carry only minimum amounts of coverage – you should seriously consider buying UIM to fully protect yourself. - Medical Payments

You also have the option to add some type of medical payment coverage. It is a no-fault type of coverage that pays out-of-pocket medical bills and expenses. This insurance can keep your bills out of collections and increase your total compensation in the end. - Collision

This coverage pays for your car’s damages regardless of who is at fault. If you cause the crash, your insurance company should still take care of paying your claim if you carry this coverage. Even if someone else is at fault, your insurance company will likely take care of the repairs upfront and then later on go after the other driver’s insurance company to get reimbursed. If you finance your car, the lender may require you to carry this insurance. - Comprehensive

This optional coverage will pay for damages that are not collision-related such as a tree branch or hail damage. The newer your vehicle, the more important this coverage becomes. - Gap

Gap insurance is an optional insurance policy. This coverage may help pay off the difference between the remaining balance on your lease or loan and your car’s ACV (actual cash value) if your vehicle is totaled. For example, you buy a new car for $20,000 and you still owe the bank $15,000 when it is totaled, even though its ACV has depreciated to $10,000. Your gap policy insurance can help cover the $5,000 you still owe on the vehicle, so you don’t have to come up with these funds out of pocket.

Read the fine print of any auto insurance policy you currently have or are considering buying. Here are some important “red flags” you may find buried in the fine print:

- Stacking Exclusions

South Carolina law allows stacking. In other words, if an uninsured or underinsured driver hits you, then you can add together multiple insurance policies to cover your damages. However, some insurance companies play with their policy language to avoid stacking. - Offsetting

If you file an uninsured or underinsured motorist claim, the insurance company may try to avoid paying you amounts that have already been covered by another source such as workers’ compensation. However, not all these “offset” clauses will survive a court’s scrutiny. - Other Exclusions

When you review an auto insurance contract, you should focus on the exclusions section. For instance, look for what happens if you are injured while driving a vehicle you do not own. Also, look for how your insurance company defines a “non-owned vehicle.” Is it just rental cars? What about a friend’s vehicle? What if your employer asks you to run an errand at work?

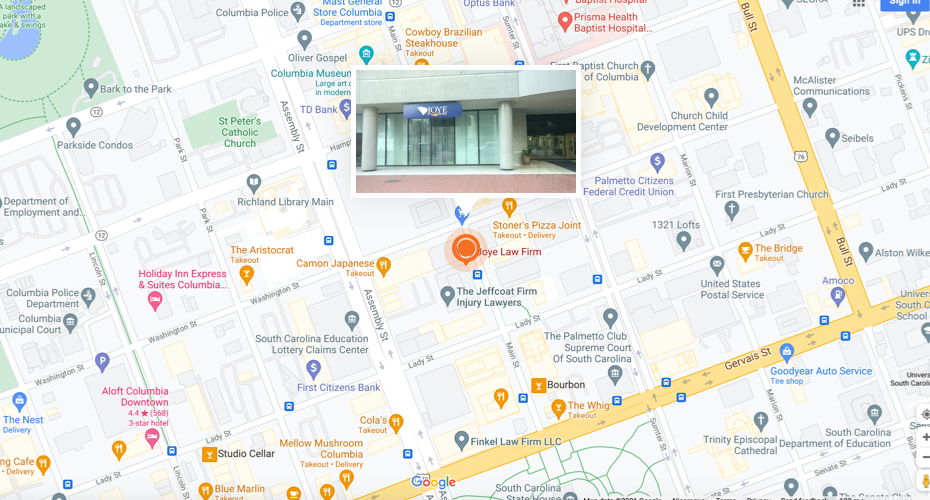

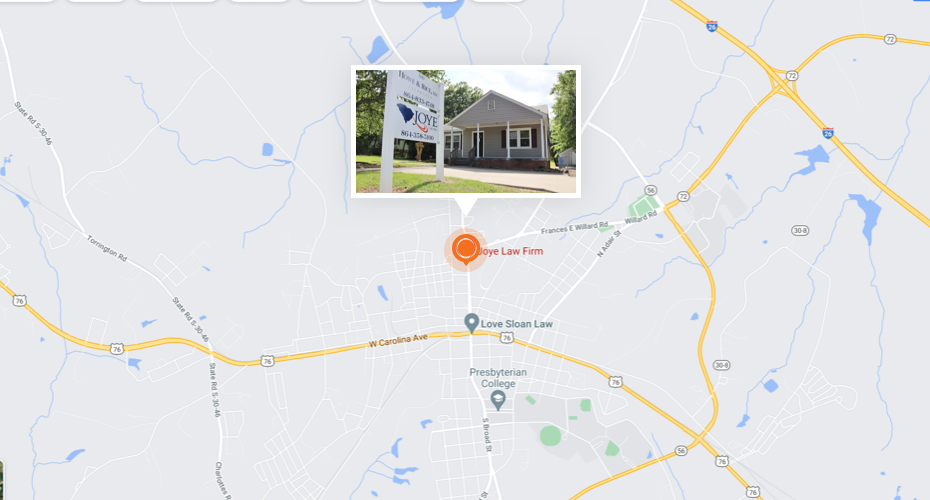

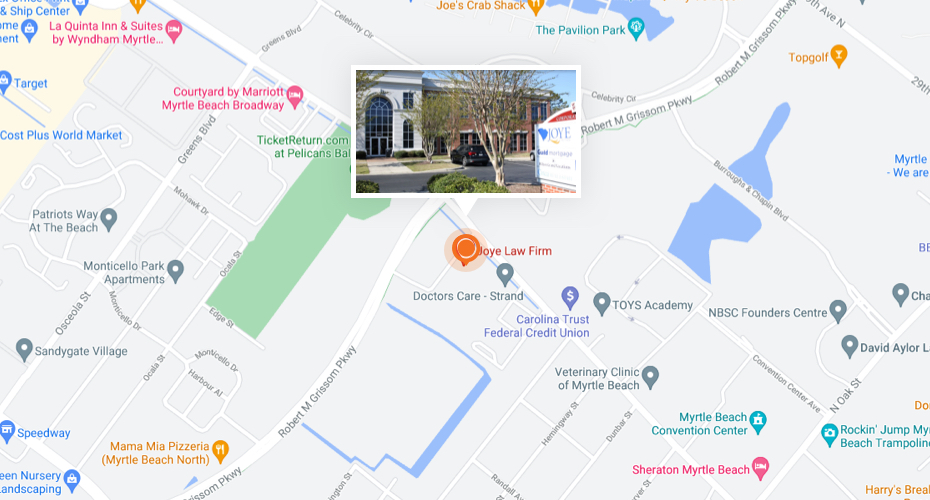

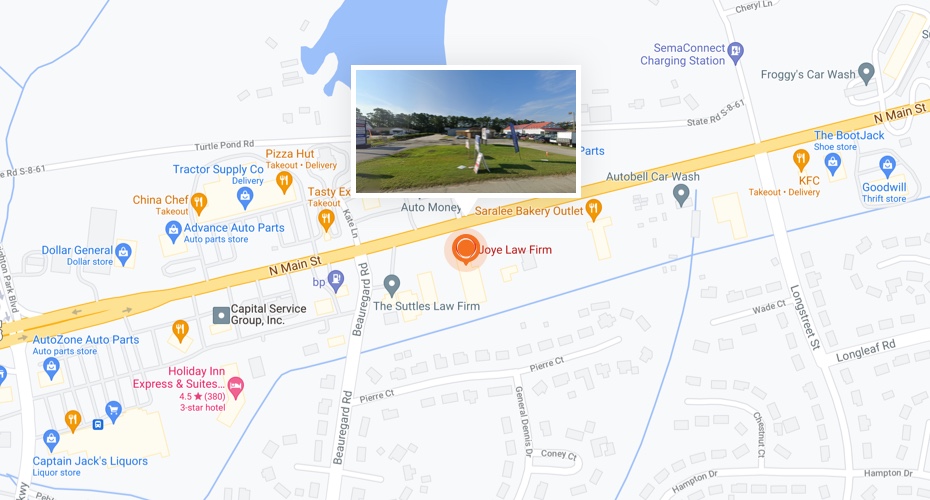

If you get involved in any type of crash, make sure to contact an experienced South Carolina car accident lawyer at Joye Law Firm right away. We will provide a free consultation about your case and carefully review your auto insurance policy. Our goal will be to explore all sources of compensation and pursue every dollar you are entitled to receive. Call or reach us online now to get started.