What to Do if At-Fault Driver of a Car Accident Does Not Have Car Insurance

Car accidents are bad enough, but when the at-fault driver of a Charleston car accident does not have car insurance, the headache becomes even more compounded. Whether you were seriously injured in the accident, your car was severely damaged, or both, car insurance protects both the driver of the vehicle and any other participants of an accident, and covers any damages accrued. So when the at-fault driver does not have car insurance, the victim of the accident is left wondering: who is going to cover the cost of my damages?

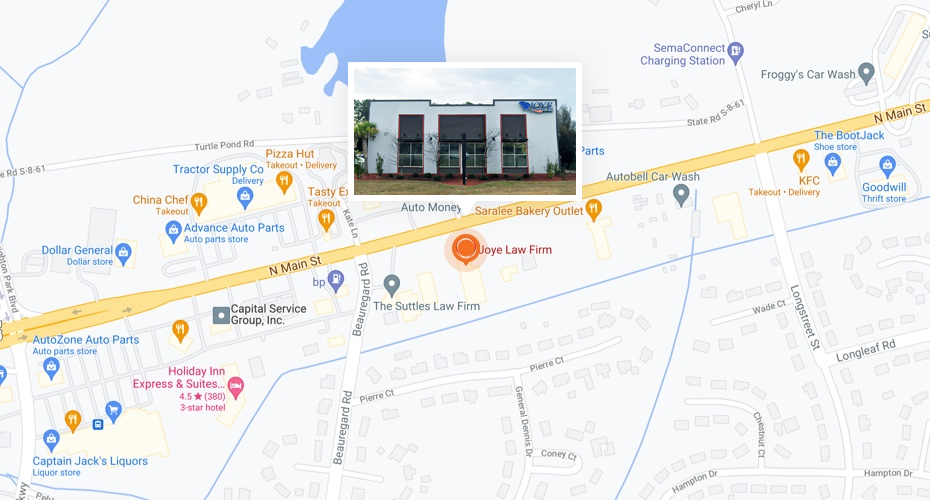

At Joye Law Firm, our Charleston car accident attorneys are adept at dealing with a variety of car accident claims, and have helped clients achieve a beneficial outcome in the event that the other driver did not have car insurance, or even when the other driver committed a hit-and-run. Our goal is help our clients identify their options when dealing with an uninsured driver in Charleston, and to reach the best possible outcome despite the given circumstances.

File an Insurance Claim With Your Own Insurance Company

If you were involved in a car accident in Charleston and the at-fault driver is uninsured, one of your options for collecting damages is to file an insurance claim with your own insurance company. Though many individuals are hesitant to do this for personal and practical reasons, sometimes it is the only option available. Uninsured motorist coverage is additional coverage that individuals can purchase through their insurance company and that is intended to cover the insured for any damages sustained in an accident with an uninsured or hit-and-run driver.

Under South Carolina Tort Law, auto liability insurance policies must contain the following three types of coverage:

- Liability insurance for bodily injury;

- Liability insurance for property damage; and

- Uninsured motorist coverage.

Uninsured motorist coverage cannot exceed the total liability coverage, the minimum of which is $75,000 in South Carolina—$50,000 for bodily injuries and $25,000 for property damage. By law, the insurance carries must charge a $200 deductible for uninsured motorist coverage.

Underinsured Motorist Coverage

While drivers in Charleston, South Carolina are not required to have underinsured motorist coverage, it is beneficial, as underinsured motorist coverage can kick in to the cover the differences between the total amount of your damages and what the other driver’s insurance carrier will pay. Many times, the other driver’s insurance policy is not enough to cover you for your personal injuries, vehicle damage, and other losses that resulted from the Charleston car accident, so underinsured motorist coverage would be beneficial to recover the full amount of what you lost.

How an Uninsured and Underinsured Motorist Claim Works

Typically, an uninsured and underinsured driver claim works in much the same way as a typical car accident claim, except that you are filing the claim with your own insurance company as opposed to the at-fault driver’s insurance company. As with all insurance claims, there will be an investigation into the facts of the accident, as well as an investigation into your medical records—current and past—and depositions of any witnesses of the accident. One key difference, however, is that if you are unhappy with the amount of compensation your insurance company is willing to offer you, you cannot file a lawsuit or claim against them.

In the event that you and your insurance company cannot agree on a settlement figure, you may bring you claim to binding arbitration, which is a panel of judges that will hear out your case and determine who wins. Whether or not you are satisfied with the outcome of arbitration does not matter; once the arbitrators make the decision, you have limited to no rights to an appeal.

Collision Coverage

Collision coverage is another unrequired but beneficial extra to add to your car insurance policy. Collision coverage will cover any damage sustained to your vehicle during a Charleston car accident, as well as any damages sustained in a hit-and-run accident or an accident in which the at-fault driver was uninsured. However, collision coverage only applies to your vehicle, and does not cover any personal injuries you may have acquired during the accident.

File a Lawsuit

In many instances, the victim of a car accident does not feel that they or their own insurance company should have to pay for another driver’s negligence. In these instances, they may opt to file a lawsuit against the uninsured driver. In some states, filing a lawsuit against an uninsured driver is impossible, as those states are “no-fault car insurance” states, meaning that the residents of those states are responsible for covering their own injuries or damages, regardless of fault. However, South Carolina is a tort-liability state, meaning that the not-at-fault driver may pursue a claim against the at-fault driver for damages sustained.

If you so choose, you may pursue a lawsuit against the uninsured driver for any and all damages sustained in your Charleston car accident. However, keep in mind that just because you are able to prove that the other driver was at fault does not mean that you will recover the full amount of compensation you seek, if you recover any. Many times, when an individual does not have car insurance, it is not because they choose to not have car insurance, but simply because they cannot afford it. If this is the case with the at-fault driver who hit you, the judge will not force them to pay you because they likely have nothing to pay with. Furthermore, the likely do not have any assets, which means that the judge cannot put a lien on any of their property until payment is remitted. Because of this, filing a lawsuit against an uninsured driver in Charleston is oftentimes a losing battle.

Let Our Charleston Car Accident Attorneys Do the Work for You

If you or a loved one has been involved in a car accident in which the at-fault driver has no insurance, it may be in your best interests to contact a Charleston car accident attorney to help you pursue a claim in the most effective way possible. Whether this means filing a claim with your own insurance company or suing the at-fault driver will be something that our lawyers determine once they have all the facts of the case, and once they have done a thorough discovery of any potentially hidden assets of the other driver.

A car accident can have serious implications on your life, and you deserve to be compensated for any and all damages that you suffer. At Joye Law Firm, our Charleston car accident attorneys can help you file a personal injury claim, compile the necessary evidence for proving your case, and achieve a beneficial outcome. To consult with one of our Charleston personal injury lawyers, contact us at (888) 324-3100 or online today.