If you were injured in a car accident as a passenger, you might wonder about your rights to seek compensation for your losses. There’s good news. Most passengers hurt in South Carolina car accidents have the same ability to pursue compensation as their drivers. You don’t have to shoulder the financial burden of your injuries from a crash you didn’t cause.

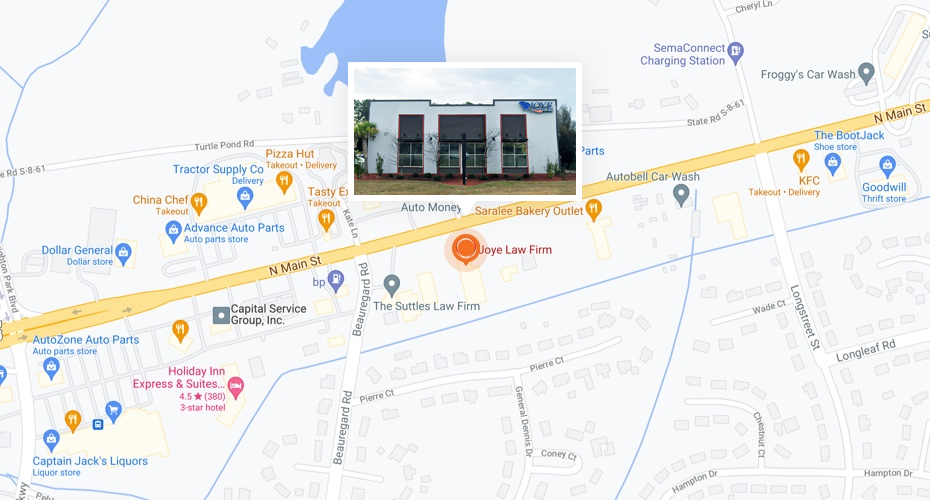

Filing an insurance claim or lawsuit after a crash may seem overwhelming, particularly if you sustained serious injuries and face a lengthy recovery process. Although nothing can undo the harm you suffered, a successful personal injury claim could alleviate your stress and help you move forward. An experienced car accident lawyer from Joye Law Firm can help by guiding you through the process, negotiating with the insurance companies, and if necessary, taking your case to trial.

Whether you were hurt in a two-vehicle crash, a truck accident, a rideshare accident, or another traffic crash, our legal team will pursue maximum compensation for your losses. Just call Joye or contact us online for a free consultation.

Case Study: Mark Joye Represents Two Sisters Injured as Passengers in High-Speed Crash

When two sisters accepted a ride in a friend’s brand-new Tesla, they had no idea their lives would change forever. Their driver was reportedly speeding at up to 80 miles per hour when took a curve too fast and lost control of the car, running off the road, and striking two trees.

The sisters both suffered severe injuries requiring in-patient care, surgeries, and months-long physical therapy for months.

Attorney Mark Joye, head of Joye Law Firm’s litigation department took on the case and fought for justice on behalf of the sisters. Ultimately, Attorney Joye successfully secured a $2.41 million settlement that will cover not only their existing medical bills but future medical needs as well.

Read the full case study here.

Understanding Compensation for Injured Passengers in South Carolina Car Accident

South Carolina law allows passengers injured in car accidents to seek compensation for their losses. The process begins by filing a claim with the at-fault party’s insurance company. If the driver of the car you were riding in caused the accident, you could file a claim with their insurance provider. If another driver was responsible for the accident, you might file a claim with their insurance company.

Insurance issues get more complicated if the at-fault motorist is a commercial truck driver, rideshare driver, government agency, or some combination of parties. The same is true if the at-fault driver flees the scene or is uninsured or underinsured. It’s wise to speak to a knowledgeable car accident lawyer to ensure you pursue compensation from all potential sources.

What Types of Compensation Can I Receive as an Injured Passenger?

As an injured passenger, you may be able to pursue compensation for financial and personal losses from a car accident, such as:

- Past, current, and future medical expenses

- Lost wages

- Lost future earning capacity

- Physical pain and suffering

- Emotional distress

- Mental anguish

- Loss of enjoyment of life

- Lost quality of life

Working with a proven car accident lawyer is the key to maximizing your compensation. A South Carolina attorney can place an appropriate value on your case that can serve as a starting point for settlement negotiations.

Does Car Insurance Cover Passengers in South Carolina?

Passengers are covered by car insurance in South Carolina. Depending on the circumstances of the accident, injured passengers may be covered through one or more of the following:

- The at-fault driver’s insurance carrier – You can file a claim with the responsible driver’s insurance company. South Carolina drivers must carry liability auto insurance that includes bodily injury coverage of at least $25,000 per person. Liability coverage pays for an injured passenger’s medical bills and other costs up to the driver’s policy limits.

- Uninsured motorist (UM) coverage – Uninsured motorist coverage is required in South Carolina. Drivers must carry uninsured motorist coverage with at least the same amount as the liability minimum of $25,000 per person. If the at-fault driver does not have insurance, you can file a claim with your insurance company for compensation.

- Underinsured motorist coverage (UIM) coverage – Underinsured motorist coverage is not mandatory in South Carolina. Still, it’s a good idea to obtain this coverage, which protects you in the event the cost of your medical bills exceeds the at-fault driver’s policy limits.

- Medical Payment (MedPay) or Personal Injury Protection Insurance (PIP) – MedPay coverage is not required in South Carolina, but drivers can purchase it. Injured passengers with MedPay coverage can file a claim with their MedPay provider for costs related to their accident-related injuries. MedPay can also cover funeral expenses in the event a passenger passes away from their injuries.