When seeking legal guidance after an injury, you may have questions about whether you will owe either state or federal income tax on the insurance settlement resulting from your personal injury claim. The short answer is no. Personal injury settlements are considered compensation for your losses, not as income. Therefore, laws are preventing both the IRS and the SC Department of Revenue from collecting tax on monies intended to compensate you for your physical injury. However, as with anything in the legal world, there are always some exceptions to the rules. In this instance, it depends on the purpose for which the damages were awarded.

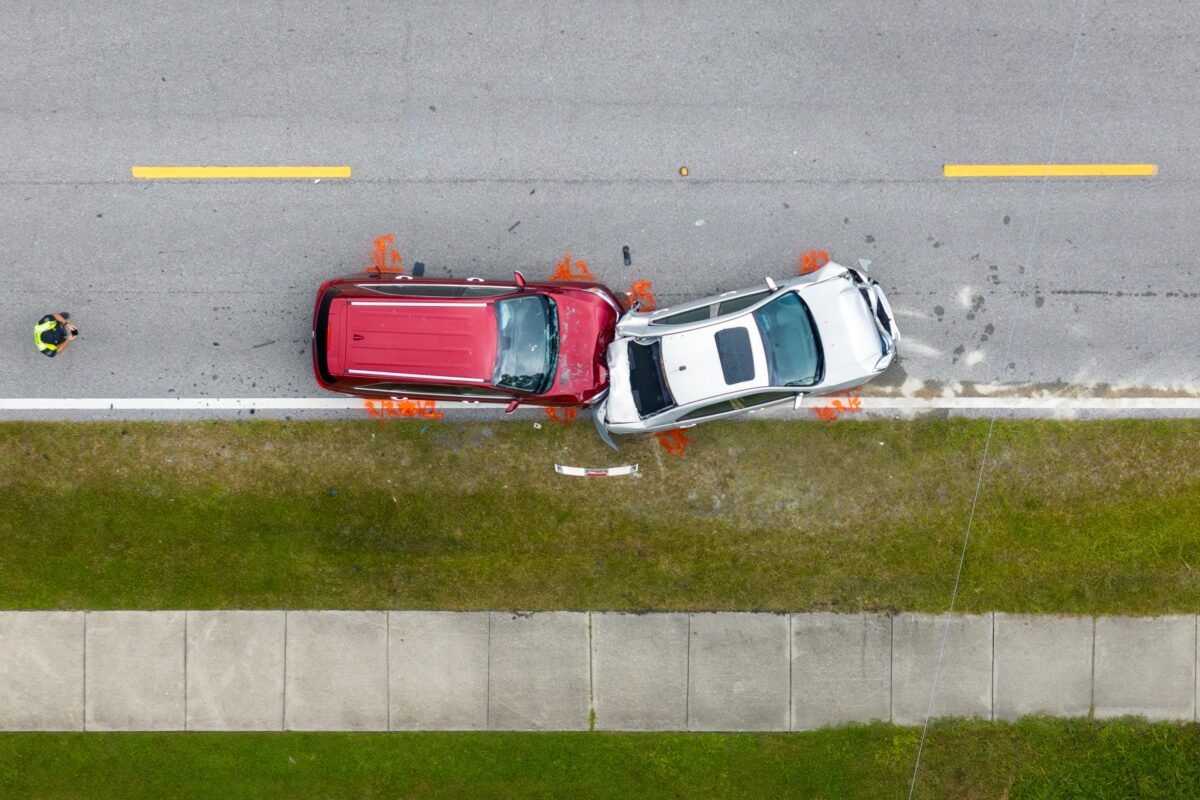

If someone causes you to be seriously injured as a result of negligence, recklessness, or criminal intent, you may seek compensation through a personal injury lawsuit. This process is meant to compensate you for your losses and make you financially whole. In some cases, an injured person may receive compensation for their pain and suffering. In special cases, a jury may award punitive damages to punish outrageous conduct. In the end, the injured person may be awarded a sizeable verdict or settlement.

Types of Personal Injury Compensation

There are two types of damages, or compensation, to be recovered in a personal injury claim:

- Compensatory damages are payable for the plaintiff’s quantifiable monetary losses, such as for medical bills, car repairs, and lost income while injured and out of work. Compensatory damages are meant to make the plaintiff financially whole.

- Noncompensatory damages are payable for the plaintiff’s pain and suffering. Punitive damages, which are meant to punish wanton acts of recklessness, are noneconomic damages that are awarded only in special circumstances.

Taxation and Compensatory Damages in a Personal Injury Claim

In general, compensatory damages in a personal injury lawsuit are not taxable. Compensatory damages, sometimes known as economic damages, reimburse the plaintiff one-for-one for their costs and losses.

Damages paid for medical bills, and property damage are reimbursements based on bills and receipts. Because there is no monetary gain, there is no reason to tax these payments. However, if the individual had deducted those medical expenses on his or her tax return a year prior to receiving the settlement, this portion of the settlement may be taxable.

Many people think that compensation paid for lost wages or diminished earning capacity (future earnings lost) is taxable because the payment is considered income, money the plaintiff had not previously accrued. That’s not the case. Because these damages in a personal injury claim are paid “on account of personal physical injuries or physical sickness,” the IRS exempts them from taxes.

Taxation and Noncompensatory Damages in a Personal Injury Claim

Noncompensatory damages paid for a plaintiff’s pain and suffering are also known as noneconomic damages. There is no exact dollar value for pain and suffering like there is for medical bills or car repairs.

Noncompensatory damages are available in South Carolina personal injury cases for:

- Pain and suffering

- Emotional distress (sometimes called “mental anguish”)

- Loss of enjoyment of life paid in cases of permanent physical disability

The federal tax code says damages for emotional distress are not taxable if they are shown to be a result of physical injuries or physical sickness. For example, serious burn injuries are undeniably painful, and the scarring or disfigurement caused by facial burns, as well as the uncertain prospects for recovery, would be cause for emotional distress. Reimbursement of actual medical expenses related to emotional distress, such as for counseling, may be exempted from taxation, as well.

However, an individual who recovered compensation in a lawsuit for emotional distress not connected to a physical injury may be taxed on all non-compensatory damages.

Punitive damages are another form of non-compensatory damages that may be awarded in special cases of willful, wanton, or outrageous behavior that leads to injury or death. Punitive damages generally are taxable, according to the Internal Revenue Service.

Talk to a Personal Injury Attorney in North Charleston

As your South Carolina personal injury attorney, Joye Law Firm would do everything possible to maximize your recovery from an insurance settlement or lawsuit while taking into consideration the tax implications. In some cases, a settlement agreement can be written to characterize the payment in a manner that results in its exclusion from taxable income, and the IRS will typically honor the intent of the parties.

Contact us today about pursuing compensation for your injuries in a car accident, motorcycle accident, slip and fall accident, or another personal injury someone else has caused you. An initial consultation is always free, and we do not charge a fee unless we recover money for you. Joye Law Firm has offices in Charleston, Columbia, Clinton, Summerville, and Myrtle Beach. We represent injured people across South Carolina. Call now.