Driving comes with inherent risks, and car accidents can happen even when you’re cautious. Unfortunately, they occur more frequently in South Carolina than in almost any other state. South Carolina has the second most fatal car accidents per capita of any state in the U.S. South Carolina’s roads are dangerous, and often the minimum auto insurance fails to provide adequate compensation for motorists harmed in crashes.

Contact a South Carolina car accident attorney immediately if you are in an accident if injuries are involved. They know the rules of insurance claims and will fight on your behalf to get the compensation you deserve from insurance companies and the negligent driver.

Minimum Required Auto Insurance in South Carolina

South Carolina requires drivers to have an active auto insurance policy. The minimum car insurance policy protects drivers against bodily injury liability, property damage liability, and provides uninsured motorist protection.

It does not have underinsured driver protection, collision coverage, comprehensive coverage, or medical payments. However, while none of these are legally required, they are all available for purchase.

Without proper insurance coverage, you will be responsible for your own medical bills if the driver who hit you doesn’t have sufficient coverage or money to pay for your injuries.

What Do Minimum Policies Cover?

Bodily injury liability coverage

Bodily injury liability coverage pays for other people’s injuries when you are at fault in an accident. The minimum insurance policy pays out up to $25,000 per person, but caps at $50,000 per crash, regardless of how many people were injured.

That means you have to pay for any medical expenses once those bills exceed the insurance limits. For example, if you cause an accident that results in $35,000 in medical bills for the other driver, your insurance will pay $25,000, and you will have to pay the additional $10,000 out of pocket. If there are three people injured (the driver and two passengers) and each has $20,000 in medical bills for a total of $60,000, insurance will pay no more than $50,000 and you will be personally responsible for the remaining $10,000.

Property liability coverage

In a car accident, property liability coverage pays for damages you cause to others’ property. This usually means the cost to repair the other vehicle, but it is not limited to that. It also includes buildings, fences, and any other physical item of value. For example, if the other driver had personal property in the vehicle that was damaged in the crash, such as an expensive smartphone, they could request compensation to replace it. The minimum coverage pays $25,000; you have to personally pay for property damage exceeding this amount.

Uninsured motorist coverage

If an uninsured driver causes bodily injury or damages your property, your uninsured motorist (UM) coverage will pay for the damages. Hit-and-run accident claims can also be filed using uninsured driver coverage. The payouts are the same as the liability coverage: $25,000 for one person’s medical bills, $50,000 for multiple people’s medical bills, and $25,000 for property damage.

Since you don’t know who the at-fault driver is in a hit-and-run, you cannot file a claim for compensation with their insurance carrier, so you must go through your own. In this case, your insurance company may charge you the deductible before paying you out of your UM insurance.

If the at-fault motorist is ever found, your insurance provider should reimburse you for the deductible.

Options for More Coverage

While not legally required, getting more insurance coverage than the minimum is smart. Auto accidents cause serious damage to property and expensive injuries to the people involved. The average 3-day hospital stay in the United States costs over $30,000, which is already $5,000 out of your own pocket if you have minimum coverage and injure someone in an accident.

You can pay more for better coverage that increases the payout’s upper limit. You can also get underinsured coverage, collision coverage, and comprehensive coverage.

Underinsured coverage pays out when you are in an accident where the other person is at fault, but their insurance does not cover all your medical bills or property damage.

Collision coverage and comprehensive coverage protect your vehicle. Collision coverage pays out when your car is damaged in a crash or collision with another vehicle or a stationary object like a fence. Comprehensive coverage protects your vehicle against all other potential damage like theft, vandalism, fire, falling objects (like trees or hail), and collisions with animals. Car repair often costs more than buying a new car, and without this coverage, you are left footing the cost on your own.

How Car Accident Attorneys Can Help You

If you are in an auto accident, you should immediately contact an attorney, especially if the other driver is at fault. Our car accident attorneys know the stress a car accident can cause, especially when injuries are involved.

Even if you have premium insurance, you may struggle to get fair compensation from insurance companies. This is because they are incentivized to pay as little as possible.

The insurance companies may try to pay less than you deserve, which is why you should not give official statements to them or accept any offer until you talk with a lawyer. Your lawyers can advise you on how to proceed and handle document acquisition so you can focus on recovering.

If the accident resulted from the other motorist’s negligent driving, you may qualify for compensation. You should not bear the responsibility for financial losses and emotional damages because of someone else’s poor decisions. An attorney can help you determine if legal action is suitable for your case.

Protect Yourself with Insurance and Legal Representation

South Carolina is dangerous to drive in, so you should protect yourself with more than the minimum auto insurance policy. Better insurance provides more monetary compensation if you get into an accident, and better protection from liability if you’re found at fault.

With premium insurance policies and legal representation on your side, you can feel safer on South Carolina roadways.

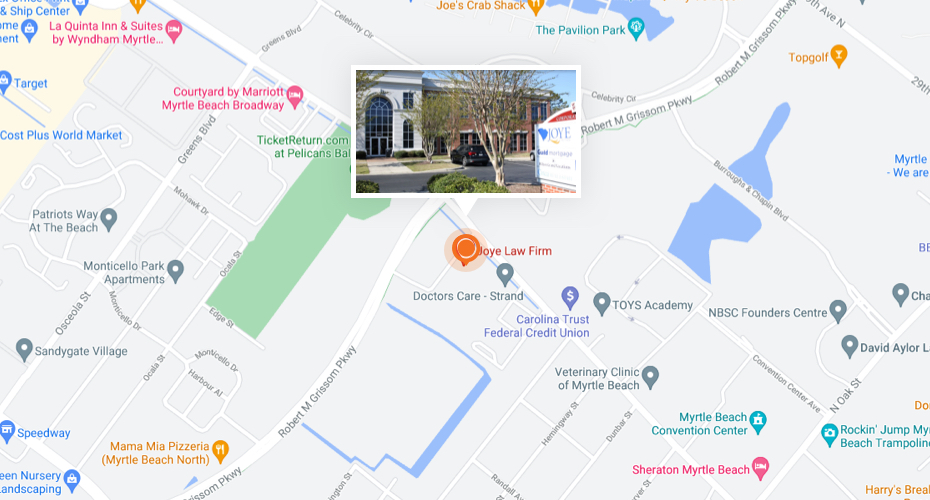

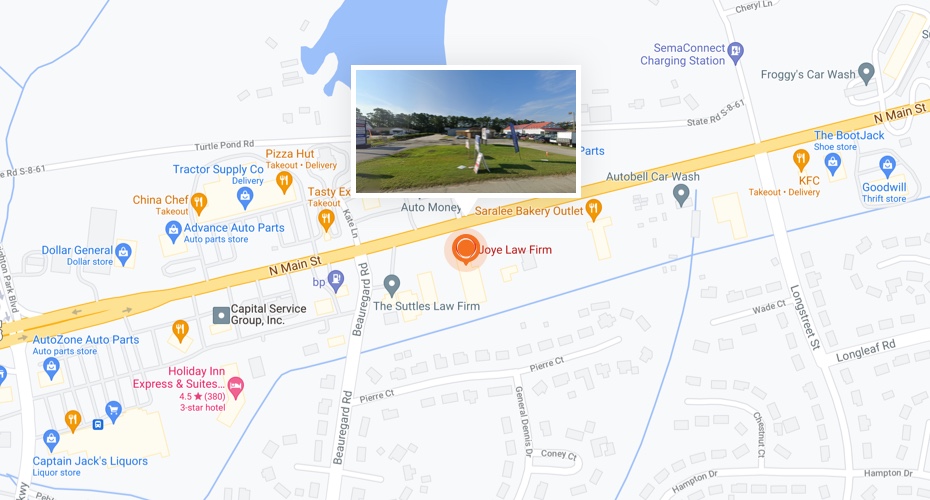

At Joye Law Firm, we have over five decades of experience helping people recover from car accidents. Whether you need assistance with your insurance company or were injured by a negligent driver, we want to help. Contact us for a free case consultation.