Most employers in South Carolina must legally carry workers’ compensation insurance. However, if you discover your employer doesn’t have workers’ compensation coverage, you can still find ways to receive benefits for your work-related injury or illness.

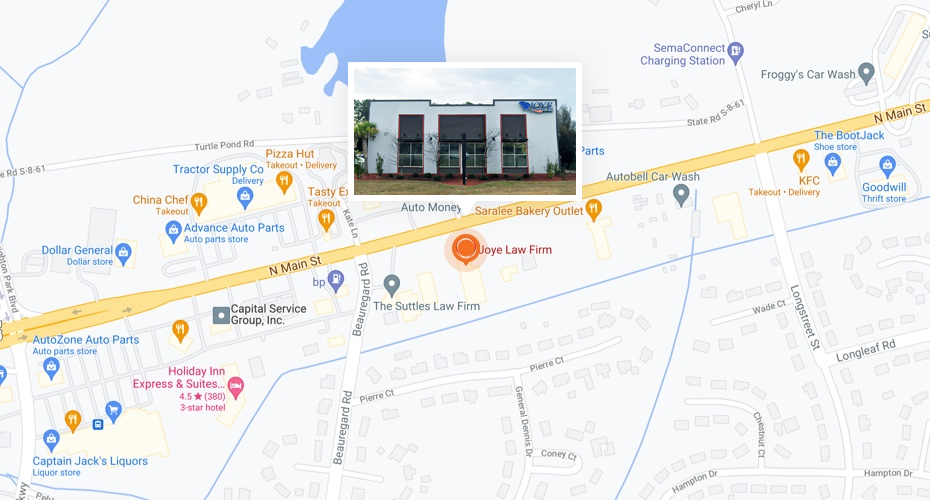

Read on to learn how to obtain compensation when your employer doesn’t have workers’ compensation insurance. If you need legal assistance for receiving workers’ compensation, contact the South Carolina workers’ compensation attorneys at Joye Law Firm.

What Types of Employers and Workers Do Not Require Workers’ Compensation?

South Carolina requires employers with four or more employees to carry workers’ compensation insurance. Employees include family members and part-time workers. Some employers and workers are exempt from this requirement under SC § 42-1-360:

- Agricultural workers

- Federal personnel

- Real estate agents working on commission

- State and county fair associations

- Railways and railway express companies

- Owner-operators of tractor-trailers, tractors, or other vehicles

- Businesses with fewer than four employees or annual payrolls under $3,000

Workers’ compensation coverage is also unavailable to casual employees. The term casual employee refers to an employee who works sporadically for an extended period. If you aren’t sure whether you are covered by workers’ compensation, consult with one of the workers’ compensation attorneys at Joye Law Firm for a free case evaluation.

How Do I Find Out if My Employer Carries Workers’ Compensation Coverage?

When you suffer an injury, you can determine if you qualify for workers’ compensation benefits by reviewing the terms of your employment contract and handbook. You can also speak with an attorney to understand whether your employer is legally required to provide these benefits.

If your employer has the required coverage, your supervisor should inform you how to file a workers’ compensation claim after you report your injury, which must be done within 90 days. As soon as your employer knows about your injury, they should submit a claim to the commission to start the process so you can pursue benefits.

If your employer refuses to verify that they have workers’ compensation coverage, you can check their coverage online at the Workers’ Compensation Commission. The commission maintains a coverage verification system for all employers with workers’ compensation insurance.

What Are My Options if My Employer Doesn’t Have Workers’ Compensation Insurance?

If your employer lacks workers’ compensation insurance or fails to submit a claim, you can work with your attorney to file a lawsuit or a claim with the South Carolina Workers’ Compensation Commission. Your attorney from Joye Law Firm can help you navigate the process and get the compensation you deserve.

Option 1: File a Personal Injury Lawsuit Against Your Employer

A lawsuit against your employer may be an option if you are ineligible for workers’ compensation benefits. A personal injury lawsuit can serve as an avenue to seek justice from an employer whose negligence resulted in your injuries and help you obtain compensation to pay for your lost wages and medical bills. A benefit of a lawsuit over a workers’ compensation claim is that a lawsuit allows you to pursue damages for pain and suffering in addition to your missed paychecks and medical expenses.

Work with a knowledgeable workers’ compensation attorney from Joye Law Firm to help you file your lawsuit. We can help gather evidence of the accident, witness statements from your colleagues, and medical records to connect your employer’s negligence to your injuries. Then, we can work with your employer to negotiate a settlement and take your case to trial if needed.

Option 2: Obtain Coverage from the State’s Uninsured Employer’s Fund

You can obtain workers’ compensation coverage through the Uninsured Employers’ Fund if your employer doesn’t have workers’ compensation insurance but is supposed to cover you. The fund ensures that injured workers receive their benefits when their employers don’t have workers’ compensation coverage.

When the Workers’ Compensation Commission receives your claim, they will determine if your employer has workers’ compensation coverage. If they find that your employer is required to carry workers’ compensation coverage under the law but doesn’t carry it, the commission informs the fund of your claim.

The fund then places a lien on the employer’s assets to cover your costs and benefits. The fund files the notice of lien with the county clerk or the register of deeds where the employer holds assets. The employer’s sales or transfers of assets during the claim process go toward the lien. The fund also has priority over the employer’s assets in case of the employer’s bankruptcy or placement into receivership.

Seek Assistance from a Workers’ Compensation Attorney with Joye Law Firm

Joye Law Firm’s experienced workers’ compensation attorneys understand the South Carolina workers’ compensation system. With our extensive knowledge of workers’ compensation law, we know who is entitled to receive benefits and which employers must carry insurance.

If you believe you deserve benefits from your employer but are unsure of your rights, we can discuss your situation and explore your options. One of these options may include filing a claim with the Uninsured Employers’ Fund.

Contact our law office today for a free case review by completing our online form or reaching out to us by phone.