Originally published April 18, 2022.

A car that has been damaged in a crash can suffer from “diminished value” after the accident. Even after the vehicle is repaired, the presumption is that a previously wrecked vehicle will be somewhat less marketable and have less value when sold or traded. The newer the damaged car is, the more likely it is to have diminished value.

“Diminished value” refers to the difference in your car’s market value before and after a collision. In South Carolina, a car owner may file a diminished value claim to recoup some of their loss. A successful diminished value claim pays the car owner the dollar amount difference between the car’s value before and after the crash.

The key to obtaining a proper insurance settlement for property damage in a car accident is to have some idea of how diminished value is determined. Each insurance company follows the same basic approach to determining the diminished value of a crashed motor vehicle, as summarized below.

Four Steps to Determining the Diminished Value of Your Crashed Vehicle

To determine the current value of a car for insurance purposes, most insurers will:

- Consult the Kelley Blue Book and/or the National Association of Automobile Dealers’ Guides, or NADA Guides. These allow the user to enter a vehicle’s make, model and mileage to obtain an estimated sales value.

- Apply a 10% loss cap, known as the base loss of value. This assumes that a vehicle in an accident could lose up to 10% of its sales value as estimated by NADA or Kelley Blue Book. So, if NADA or the Blue Book say the car is worth $15,000, the insurer has decided that, at maximum, the diminished value after an accident and repair could be $1,500. This is the “base loss value.”

- Apply a damage multiplier. Now the insurer looks at the actual damage to the car and determines what it detracts from the vehicle’s worth by applying values for a range of damage:

- 00: Severe structural damage

- 75: Major damage

- 50: Moderate damage

- 25: Minor damage

- 00: No structural damage or replaced panels.

For a moderately damaged car with a base loss value of $1,500, you now have a damage-adjusted diminished value of $750 ($1,500 x 0.50).

- Adjust for mileage. This is another calculation based on established multipliers for the vehicle’s miles driven:

- 0: 0-19,999 miles

- 8: 20,000-39,999 miles

- 6: 40,000-59,999 miles

- 4: 60,000-79,999 miles

- 2: 80,000-99.999 miles

- 0: 100,000+

A vehicle with a $750 adjusted diminished value and 85,000 miles on it has suffered a loss worth $150 under the 17c Diminished Value Formula ($750 x 0.2). This is generally how insurers determine diminished value after a car accident and what many insurers would allow you to claim for property damage to the vehicle.

The value of a crashed vehicle may be described by an insurer three ways:

- Immediate Diminished Value. This is the difference in the value from prior to the accident and immediately following the accident without repairs.

- Inherent Diminished Value. This is the loss that remains after the car has been fully repaired and restored to its original condition.

- Repair-Related Diminished Value. This is lost value caused by improper repair work, whether mechanical or body work. This is loss in addition to the inherent diminished value.

The final calculation in step 4 above yields the inherent diminished value. If problems with repairs are discovered, a repair-related diminished value would be assessed, and the vehicle would be further devalued.

Filing a Diminished Value Claim in South Carolina

If someone else caused the accident that damaged your vehicle, you may be entitled to compensation for the necessary repairs, which comes from auto liability insurance held by the at-fault party or from your own uninsured/underinsured motorist coverage. You should be able to recover what you’ve lost from your vehicle’s value by filing a diminished value claim.

You may file your diminished claim (along with other claims from the accident) and await the insurer’s decision, which is likely to be based on the 17c Diminished Value Formula. You can also work to establish for yourself what a proper payment to you should be.

Again, you would begin with the Kelley Blue Book and/or NADA Guides to get a basic estimate of what your car was worth. You might research similar cars on the market in your area to see what they are selling for.

But you might also compile evidence such as mileage records, service history and affidavits from your regular mechanic to demonstrate that your car was worth more than its book value. If you had aftermarket components that increased its value, such as tires, rims or suspension, or a sound system, you would need to document their existence with receipts and photos.

It’s also possible to hire a diminished value expert to appraise your vehicle’s value after an accident.

You have the right to negotiate with any insurer and tell them what you believe you are owed. In South Carolina, if an insurance company refuses to pay your diminished value claim, you can file for auto insurance arbitration in civil court and, based on the evidence you provide, ask an arbitrator to force the insurer to pay an appropriate diminished value settlement.

Further, under certain circumstances, SC law may allow you to also pursue “punitive” damages against the at-fault party. These would be payments made to punish outrageous behavior like drunk driving. In fact, if your vehicle has been damaged by a drunk driver, it is highly recommended that you confer with a lawyer about your claim before settling it, even if no personal injuries were sustained.

How a Car Accident Attorney Can Help

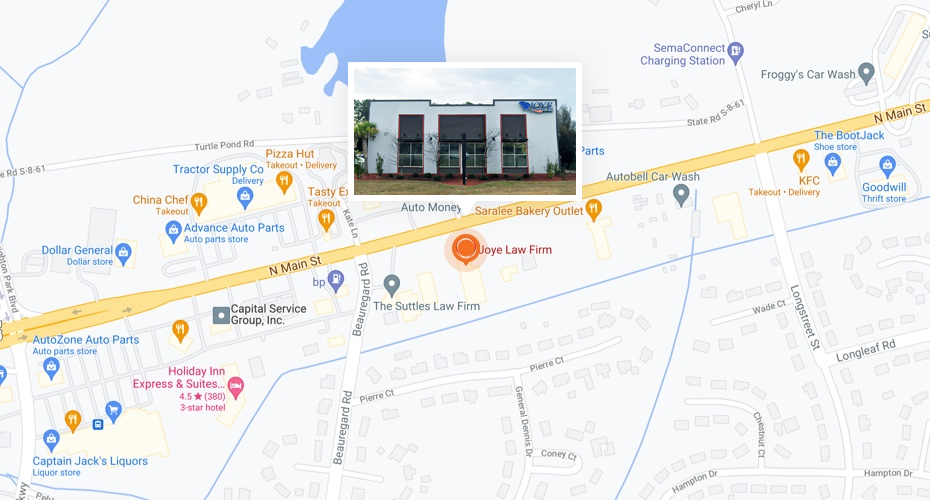

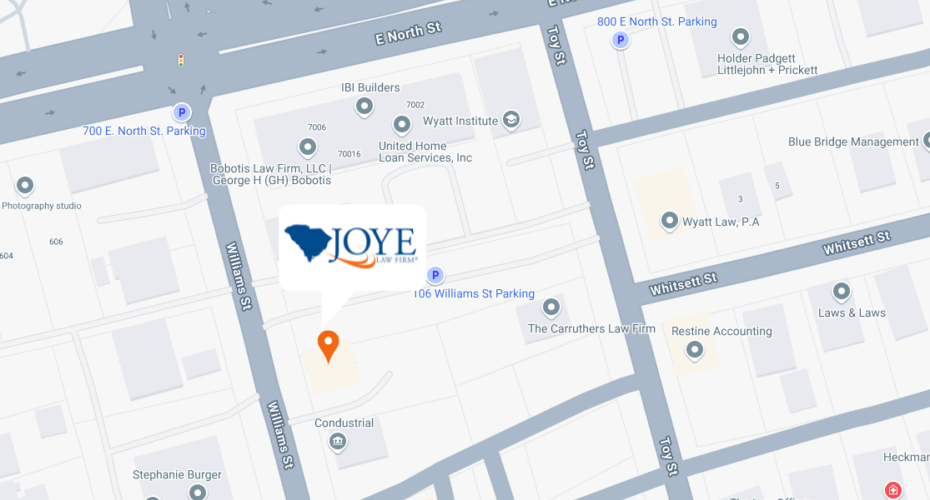

Contact the car accident attorneys of Joye Law Firm immediately after a car accident involving injuries, and we can advise you as to what types of compensation you may be entitled to seek. If you have a personal injury claim, we can handle all of the paperwork required by insurers and negotiate on your behalf for a proper settlement. We also take cases to court when necessary to obtain justice.

If you have been in a car accident in Columbia, Myrtle Beach, North Charleston, Summerville, Clinton or anywhere in South Carolina, contact us at (877) 936-9707 or use this online contact form to set up a free case review.