Is South Carolina a No-Fault or At-Fault State? What Does this Mean for Drivers in Accidents?

Car accidents are an unfortunately common occurrence in South Carolina, and can happen to even the safest and most experienced of drivers. While traffic, road, and weather conditions often contribute to car crashes and collisions, the majority result from reckless driving behaviors such as speeding, driving under the influence, and using cellphones and texting behind the wheel. Unlike so-called “no-fault” states, South Carolina uses a fault-based system for dealing with car accidents, meaning the at-fault driver themselves can be held legally liable for any costs you incur. In a no-fault state, each damaged party exhausts his or her own personal insurance first, no matter who caused the accident.

South Carolina Insurance Laws

The state Department of Insurance (DOI) advises resident motorists to be aware that South Carolina is a tort liability state. This means that when there is an accident, victims with injuries or property damages may seek compensation from the at-fault driver, either through their insurance company or by filing a personal injury lawsuit. Drivers are required to carry the following minimum amounts of insurance coverage in the event of an accident:

- Bodily injury liability: $25,000 per person, $50,000 per accident;

- Property damage liability: $25,000 per accident;

- Uninsured motorist coverage: same limits of 25/50/25 as above.

In addition to the above, you do have the option to increase coverage amounts or add on additional insurance, such as underinsured motorist, comprehensive, and collision coverage. If you are renting or still paying for your vehicle, your title holder may require you to carry this additional coverage.

The DOI also advises that your liability insurance will also cover your attorney’s fees in the event you are sued as the result of an accident. If you are accused of negligence in causing an accident and receive a summons or other legal notice in the mail, you should notify your insurer immediately. In the event a settlement is reached or a judgment is entered against you by the court, your insurance will cover the amount, up to your policy limits. Any additional amounts owed would be your responsibility.

Filing an Insurance Claim

When an accident occurs, it is important to notify law enforcement right away and exchange your personal contact information, driver’s license and vehicle registration number, and your insurance information with the other drivers involved. It is also important to report the accident to your car insurance company as soon as possible. The South Carolina Department of Motor Vehicles (DMV) advises that the investigating officer at the scene of the accident will provide the drivers involved with a green FR-10 form. This is an insurance verification form which must be submitted to your insurance company, completed, and sent back to the DMV within 15 days of your accident, regardless of whether you were to blame for the accident. Failure to submit this form can result in suspension of both your driver’s license, as well as your vehicle registration.

According to insurance provider Esurance, insurance companies have two primary ways of determining who is at fault for a car accident:

- Evidence gathered at the scene, which may include police reports, photographs or traffic videos, and witness statements;

- Your own statements, both immediately at the scene as well as statements made to your own or the other driver’s insurance claims representative.

Statements you make can be used to deny your claim, or dispute the total amount you are entitled to receive. In addition to being a fault based insurance state, South Carolina also follows the theory of comparative negligence. This means that while you could still collect on an accident for which you are partially to blame, the amount you would be entitled to receive would be reduced in proportion to your degree of responsibility.

Let Us Help You Today

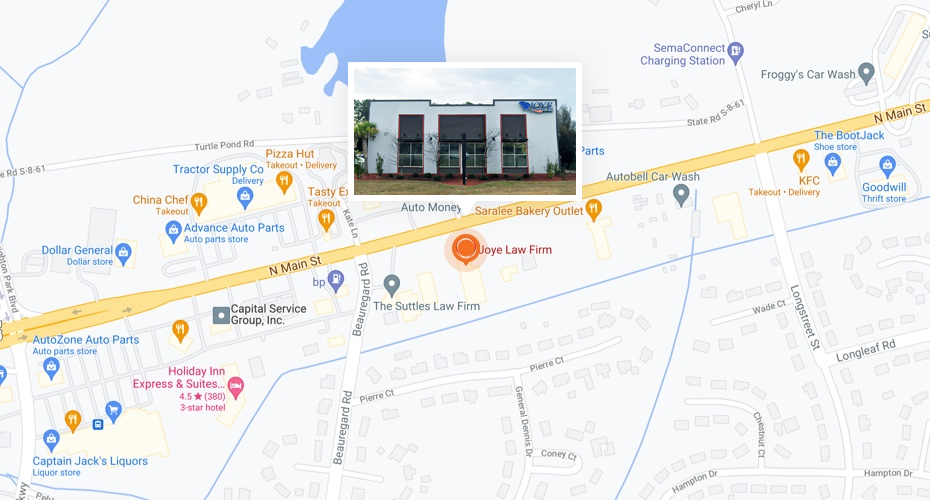

If you are involved in an accident, before making any statements to the insurance company or signing any documents, contact our experienced South Carolina car accident attorneys right away. At the Joye Law Firm, we provide the professional legal representation you need to protect your rights and interests in these situations. We work hard to gather the evidence needed in support of your claim, so you can get the maximum amount of compensation you are entitled to recover for your injuries. We offices in Charleston, Clinton, Columbia, and Myrtle Beach, and we are eager to assist you today.