Most people assume that any settlement they receive from a personal injury lawsuit will come as a lump sum. While this is the most common form of settlement, you may have the option to accept a structured settlement instead, which pays out consistently over time rather than all at once. Structured settlements are usually offered when the settlements are extremely large, such as when a victim is left permanently disabled.

If you are offered a structured settlement rather than a lump sum settlement, should you take it? We go over the pros and cons of both options.

Lump Sum Settlements

Lump sum settlements, in which the accident victim receives all their compensation in a large one-time payment, are the most common type of settlement.

Pros:

- Lump sum settlements provide the most freedom. After satisfying any medical liens (which will be handled by the attorney), recipients can use the money at their complete discretion, whether that means paying off their mortgage, putting it toward a college fund for their child, or taking a much-needed vacation to shrug off the stress of the accident and injury. It’s your money and you can use it however you want.

- Have a large sum of money at the ready also means you are more able to meet any financial crises you might face in the future.

Cons:

- Many accident victims often find they are pressured by friends and family to share their settlement money after winning a large settlement. As your settlement is intended to compensate one person (you), not dozens of acquaintances, you may find it running out too fast if you agree too often. And once it’s gone, it’s gone for good.

- Many accident victims may also be unused to managing large sums of money on their own, which may necessitate hiring a financial advisor to figure out how to invest it properly.

Structured Settlements

In a structured settlement, victims receive a series of smaller payments over time through an annuity purchased by the insurance company.

Pros:

- Structured settlements are incredibly flexible, with recipients being able to choose both the size and frequency of their payments. For example, you could choose to receive a large payment once a year, a smaller payment once a month, or any number of other combinations.

- Structured payments can act as a source of guaranteed income.

- You don’t have to worry about losing your settlement to bad investments or about being pressured to give it away to friends and family.

Cons:

- Structured settlements are inflexible.

This may seem like a contradiction to the point previously made in the “pros” section, but once a structure is selected at the start, it cannot be changed later on. For example, if you decided to receive one large payment once a year, but you have an unexpected expense halfway through the year, you will not be able to get an advance on your payment.

Essentially, although it is your money, you do not have access to the majority of your settlement.

You may have seen commercials on television encouraging people in the exact situation described above to “sell” their structured settlement in exchange for an immediate lump sum payment. However, be cautious. These are often predatory lenders, which is why accident victims in South Carolina are protected by the Structured Settlement Protection Act.

This law will make it harder to sell your structured settlement annuity, but only to protect you from fraud. Before being able to sell your structured settlement annuity, the following must occur:

- The sale must be court-approved.

- The sale must be in the best interests of the accident victim, as well as their dependents (if applicable).

- The accident victim must have any fees associated with the sale explained to them.

- The purchaser of the annuity must advise the accident victim in writing to seek professional financial advice before going through with the sale.

- The sale can be “called off” if the accident victim changes their mind within a set time frame.

Need Compensation After an Accident? Let Us Handle the Details

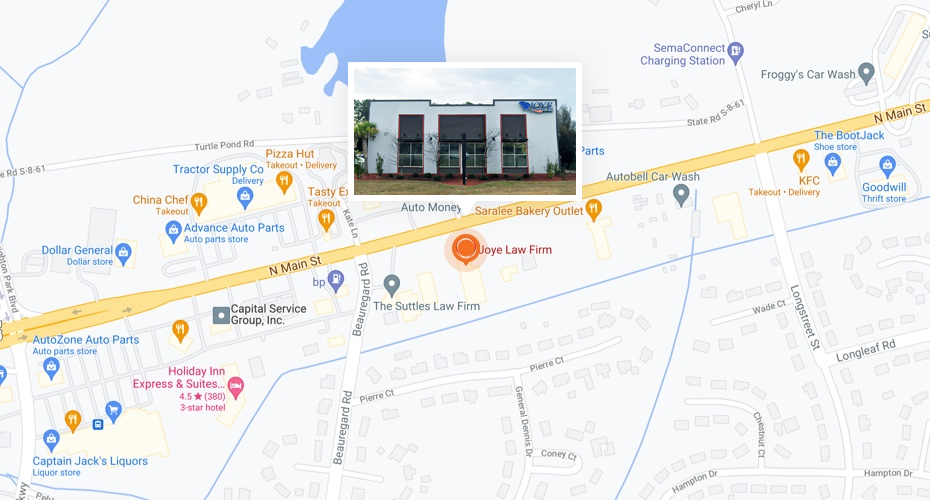

If you are injured and in need of compensation, the team at Joye Law Firm will not only fight to get you the maximum compensation possible for your injury, we can advise you on which type of settlement may be right for your needs after your accident.

For a free consultation, contact our South Carolina personal injury attorneys today.