Letting a friend or family member borrow your vehicle is a common practice. In many households, family members share a single car registered and insured by one household member.

While lending your vehicle might seem harmless and convenient, you may need to pay for the resulting damages and injuries if the person borrowing your car causes a wreck.

To protect yourself and handle the situation effectively, here are the steps you should take if someone borrows your car and gets into an accident:

File a Police Report

After ensuring your friend or family member who borrowed your car is okay, you should double-check that they filed a police report.

Hopefully, the borrower (or the other party involved in the crash) called the police immediately and filed a report at the scene. If so, request a copy of the accident report.

If not, file one immediately.

The accident report is critical when filing a claim, particularly if anyone was injured or the vehicles were damaged.

The responding officer should have also given your friend a green FR-10 Insurance Verification Form. The form confirms you have the liability insurance required by South Carolina’s financial responsibility laws.

Drivers or owners of vehicles involved in an accident must report the crash and submit the FR-10 Form to the Department of Motor Vehicles within 15 days, regardless of fault.

Contact Your Insurance Company

Contact your insurance company immediately and review your policy to determine if you’re covered when your car is in a wreck, and you are not the driver.

Who your insurance policy covers may vary, but typically it covers:

- Anyone in your household who has a valid driver’s license under your policy

- Permissive use drivers – those to whom you gave permission to drive your vehicle

You may not be liable for damages if you did not allow the driver to borrow your car or expressly excluded them from your policy. This is typically the case when you are the victim of auto theft, or if your friend takes your car without your permission.

In other words, if you allow someone to borrow your car and they cause a crash, your policy will probably pay for the damages.

If you did not allow them to borrow your car and they are insured, then their policy will likely be responsible.

- Note: You Could Be Named in a Lawsuit. Keep in mind that if you allowed another party to drive your car, particularly a party that had a bad driving record, such as a history of drinking and driving, and this party caused a crash, you could be named in a lawsuit by the victim.

Think seriously about loaning your car out to friends or family, as you may be responsible for paying for damages if the friend/family member causes a crash, resulting in injuries.

If the other driver involved in the crash (not your friend or family member) was at fault, South Carolina’s at-fault laws stipulate that this driver’s insurance policy is responsible for damages. However, if the at-fault driver does not have insurance or does not have sufficient insurance, your uninsured or underinsured motorist policy may apply.

Understanding Liability in Different Scenarios

Permission vs. Non-Permission

Permission granted: When you grant someone permission to drive your car, your insurance policy generally extends to cover the accident. This is known as “permissive use.”

However, it’s crucial to understand that your coverage may have limits. If the person driving your car is found at fault, and the damages they cause exceed your policy limits, you could be held personally responsible for the remaining amount.

Permission denied: If someone drives your car without your permission, they are an unauthorized user. In such cases, their insurance policy, if they have one, would typically be responsible for covering the accident.

If the unauthorized driver is uninsured or underinsured, this can complicate matters, potentially leading to significant out-of-pocket expenses for you, especially without a defense lawyer.

However, if your car is stolen and involved in an accident, you are usually not liable for any damages or injuries caused by the thief. Report the theft to the police and your insurance company immediately to ensure you are not wrongfully held responsible.

The situation is legally complex in cases where you didn’t explicitly give permission but implied it (e.g., a family member who frequently uses the car). Your insurance company may still cover the damages, but the circumstances surrounding the accident will heavily influence liability decisions.

Contacting The Right Type of Attorney for the Situation

Much like doctors who specialize in specific fields of medicine, proficient attorneys usually focus on one area of law to ensure high-quality results. If you come across an attorney who takes on every type of case, there’s a good chance the outcome may not meet your expectations.

Your Friend Who Borrowed Your Car Is Found At-Fault:

If the person who crashed your vehicle is at fault, it is strongly advised that you contact a car accident defense lawyer. They can review your insurance policy and advise you on what to do next. Coverage specifics vary on a policy-by-policy basis, and policy language can be very technical and challenging for the layperson. Your insurance company will also work with its own legal defense counsel to try to settle the claim on your behalf.

Understanding vicarious liability

Vicarious liability is a legal principle where the owner of a vehicle can be held responsible for the driver’s actions, even if the owner was not present during the accident. This means that if you lend your car to someone and they cause an accident, they could hold you liable for any damage or injuries that result from the crash.

This principle states that the vehicle owner must ensure that their car is driven responsibly and by competent drivers. For instance, if you lend your car to a friend who causes an accident due to reckless driving, the crash victims could sue you. Your liability can extend to various damages, including medical bills, property damage, and even pain and suffering claims.

Increased insurance premiums: An accident involving your vehicle can increase insurance premiums, even if you don’t file a lawsuit.

Insurance companies may view your policy as a higher risk if your car is involved in accidents, especially if they are caused by drivers to whom you lent your vehicle. Higher premiums can strain your finances over time, making it more costly to maintain coverage.

Remember, only an experienced legal professional can provide the most accurate information and guidance tailored to your unique circumstances.

If you have any concerns about liability or potential legal consequences, consult a qualified attorney to ensure you are fully protected.

The Other Driver is Found At-Fault:

If the other driver (not the person to whom you loaned your vehicle) was at fault for the crash that caused your friend to be injured and your car to be damaged, it’s crucial to contact a personal injury attorney. They can help you navigate the complexities of the legal system and ensure you receive the maximum compensation for your damages.

If the crash involved a drunk driver, it is even more critical to seek legal representation. Drunk driving cases often come with additional complexities, such as proving negligence and holding the driver accountable for their actions. In such cases, a personal injury attorney can help pursue not only compensatory damages for repairs, medical expenses, and other losses, but also potentially punitive damages. Punitive damages are intended to punish the at-fault party for their egregious behavior and deter similar conduct in the future. A skilled attorney experienced in handling drunk driving cases can navigate these legal challenges and work to ensure that you receive both the compensation and justice you deserve.

If you were a passenger during the crash, a personal injury attorney can also help you receive compensation to treat your injuries. They will work to ensure that you receive fair compensation for any medical expenses, pain and suffering, lost wages, and other impacts resulting from the accident.

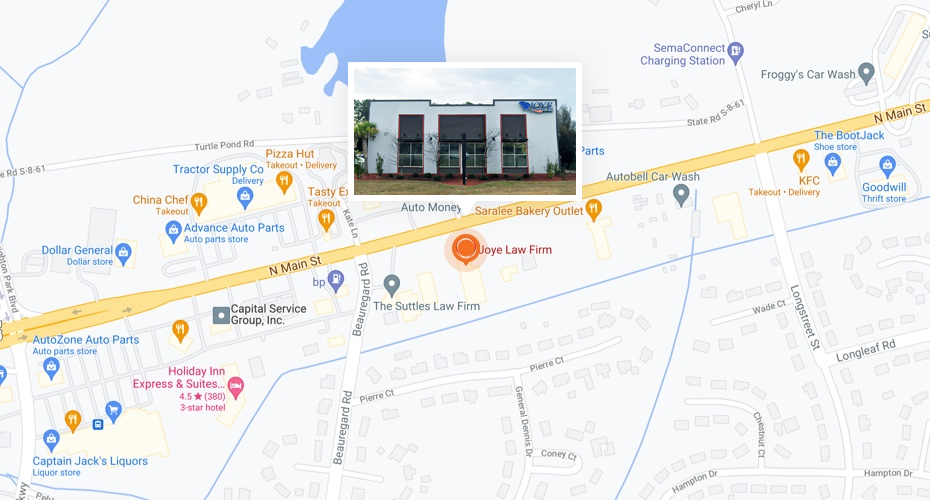

Contact Our South Carolina Car Accident Lawyers Today

Automobile insurance is very important, but can be confusing to decipher. This is especially true when someone you allow to drive your car gets in a wreck.

If you have questions about liability, please contact our experienced South Carolina auto accident attorneys at the Joye Law Firm online or by phone for your free consultation. Even if we aren’t the right type of law firm to handle your specific case, we will get you in touch with an experienced and trustworthy law firm that can better help you.

One valuable piece of advice is always to stay informed about your insurance coverage. Review your policy regularly and discuss any questions or concerns with your insurer.

If you often lend your car to others, consider additional coverage options and seek legal advice to ensure you’re making informed decisions.