Originally posted March 3, 2016

For people who sustain injuries in car accidents, huge medical bills are often a dreaded reality. Below, Attorney Ken Harrell of Joye Law Firm provides some insight regarding what he believes car accident victims can do about their accident-related medical bills. You can also watch our video on this topic on YouTube here.

Seek the Medical Care You Need After a Car Accident

While filing an injury claim can reimburse car crash victims for the cost of their medical expenses, those bills are still ultimately the responsibility of the person receiving the treatment. For that reason, many accident victims fear being unable to afford to pay their hospital bills, even knowing they will likely be reimbursed through a verdict or settlement later. They may even consider not getting all or any of the treatment they need to avoid going into medical debt.

Do not do this! Your health is of the utmost importance, and an experienced injury lawyer at the Joye Law Firm can help you find solutions in the short-term while working to get you the compensation you deserve in the long-term.

“Our goal for every client that we represent is that we want to make sure that you get full, appropriate medical care,” says Harrell. “We do not want there to be shortcuts just because you happen to be involved in an accident. Now, sometimes access to medical care can be a problem for people, particularly when they’re uninsured. In that situation, we can help you gain access to doctors who are willing to treat people based on a ‘letter of protection.’ That means that they’ll get paid when your case gets settled.”

Refusing or delaying medical treatment after an injury because of the cost can also hurt your ability to get compensation for your other accident-related expenses. The at-fault driver’s insurance company and their lawyers will likely point to the fact that you did not seek treatment as a sign that you were not actually seriously injured. They can then use this as an excuse to refuse to pay compensation for your injury-related lost wages and pain and suffering.

This is why we also recommend only ceasing treatment once your doctor fully clears you to do so. Far too many injury victims skip doctor’s appointments, or don’t follow their doctor’s recommendations for physical therapy or medication, to save money on medical expenses. This only puts their recovery at risk while hurting their chances for compensation.

What About High Deductibles?

“Even though you may have health insurance, if you’re in a situation where you need to get specialized treatment – let’s say that you need to see a knee surgeon – but you’ve got a $2,000 or $3,000 deductible, well, for a lot of people, you might as well be uninsured because they don’t have the money that they can come up with in order to get the treatment.

And again, that’s where we can help get involved in the process because we can use that letter of protection approach to make sure that you can get to a qualified surgeon so that you can get your treatment. As your bills get incurred, yes, we will do what we can to keep your credit from being negatively impacted,” explains Harrell.

What is a Letter of Protection (LOP)?

In essence, a letter of protection (LOP) is a legally binding contract with a medical provider stating that you are unable to pay for treatment now, but you have a pending personal injury claim and will pay later once you receive a settlement or jury award. Most importantly, with an LOP in place, collections agencies cannot contact you about your outstanding medical bills, so you can relax and instead focus on your recovery.

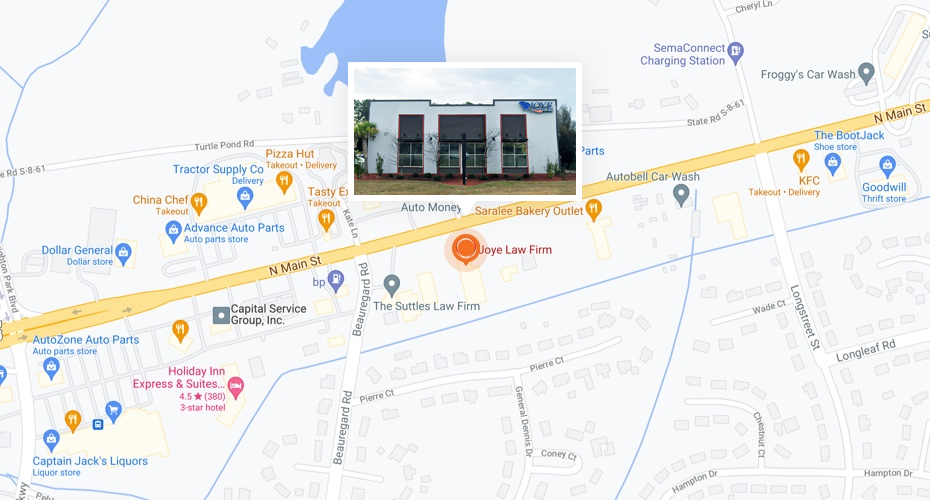

However, not all doctors will agree to accept an LOP. This is why it is so important to work with an experienced, local law firm. At Joye, we have relationships with local hospitals, doctors, and surgeons. They know us and our reputation, and they know that we don’t settle for less than our clients need.

What Do I Do About My Medical Bills After a Car Accident If I Can’t Get a Letter of Protection or Medical Lien?

“Sometimes, there is not a whole lot we can do with hospitals because they are such big, bureaucratic institutions,” says Harrell. “So, if you’re dealing with a hospital, a lot of times we’ll advise a client, ‘Look, just pay what you can monthly, even if it’s just $25 a month.’

As long as the hospital has something coming in, that can hold them off in terms of them not turning you over to a collection agency so that your credit doesn’t get impacted. We do have a good relationship with the lawyers and with the claim representatives within the hospitals that negotiate these bills. So, we can usually help you out at the end of the case, and a lot of times, depending upon how much insurance coverage there is – we have had bills for several hundreds of thousands of dollars – and we have paid maybe 5 percent or 10 percent of that amount because of the insurance coverage that is there.”

Facing Medical Bills from a Car Accident? Get Legal Help Now

If you are still worried about what to do about your hospital bills after an accident that wasn’t your fault, don’t hesitate to contact our firm. Your initial consultation is always free, and when you hire our firm, we will do everything possible to ensure you get the full compensation you deserve for your pain and suffering, even after paying back the cost of your medical treatment.

Call today to speak to an attorney about what we can do for you.