Auto insurance is legally required for all drivers in South Carolina. Auto insurance experts, according to their own data, say that the average driver will be involved in a car accident roughly once every 18 years. That means most drivers are going nearly two decades at a stretch regularly paying a significant amount of money each and every month to insurance companies without getting anything back for it.

So, when drivers do get into wrecks, they expect their insurance to do what it’s supposed to do and pay for their medical bills and for their cars to be repaired. But insurance companies are out to make money, and paying you isn’t how they do it.

When an insurance company refuses to pay a policy holder compensation on a legitimate claim, that’s what’s called a bad faith insurance claim. “Bad faith” means dishonest dealing, because the insurance company is breaking their end of the bargain.

What Are Ways Insurance Companies Show “Bad Faith?”

Insurance companies show bad faith by withholding benefits that policyholders are entitled to, or by withholding benefits for unreasonable reasons.

Examples might be:

- Failing to respond to a claim request promptly

- Misinterpreting the language in an insurance contract to get out of paying a claim

- Failing to disclose policy limits or exclusions when selling policies

- Failing to properly investigate a policyholder’s claim

- Making unreasonable demands on the policyholder to prove a covered loss

- Ignoring evidence that supports a policyholder’s claim

- Failing to pay out on a claim promptly when liability is clear, or any unreasonable delay in paying a claim

If My Settlement Is Too Low, Does That Count as Bad Faith?

If it’s simply a difference in opinion between you and the adjuster about what your claim is worth, it likely isn’t a bad faith claim. That doesn’t mean you can’t push to receive more money with the help of an experienced personal injury lawyer handling the negotiations for you after an accident.

However, if the insurance adjuster fails to provide any supporting evidence for how they made their estimate, or ignores evidence that supports your estimate over theirs, it may be a bad faith claim after all. We recommend speaking with an experienced South Carolina personal injury lawyer to see if yours might be a bad faith claim.

Can I Only Make a Bad Faith Claim Against My Auto Insurance Provider?

No, insurance providers can and do break faith on all kinds of policies, including health insurance, homeowners’ insurance, and so on.

What Do I Do When an Insurance Company Acts in Bad Faith?

When an insurance company refuses to hold to the terms of your contract, the first thing you should do is contact a lawyer.

A lawyer can get the ball rolling with a bad faith letter requesting the insurance company state their position in writing on why your claim was reduced or denied, and file a lawsuit if necessary.

In a bad faith lawsuit, you may be eligible for not only your damages from the accident, but also for consequential damages, your attorney’s fees, and potentially even punitive damages.

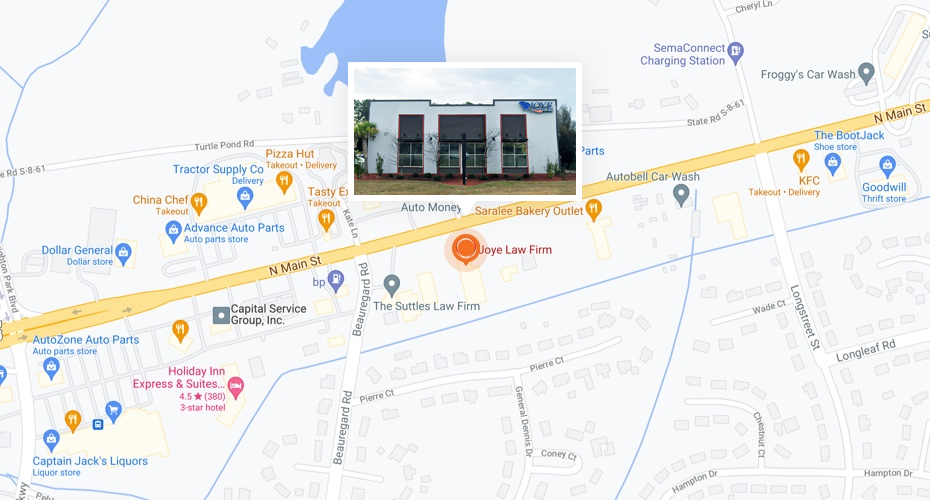

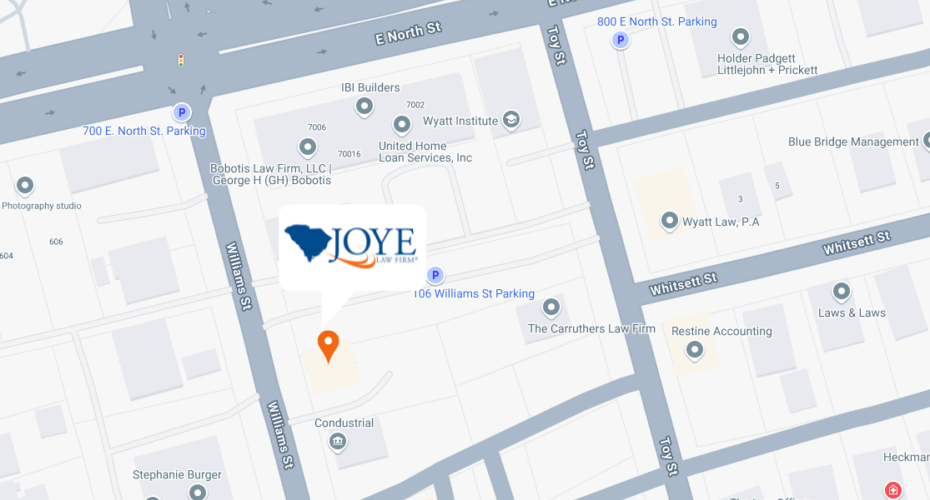

Do you suspect the insurance company has been acting in bad faith after an accident that left you injured? Contact Joye Law Firm today for a free case review.