Blog by: Attorney Ken Harrell

In handling personal injury and workers’ compensation cases for injured South Carolinians for more than 30 years, it has become apparent to me that my clients’ future medical costs are often a crucial component of their damages. In some cases, the client’s projected future treatment costs are the biggest monetary damage in the case. With that in mind, if you’ve been left with future medical treatment needs due to an accident injury, it’s important that your lawyer consider procuring a medical costs projection or a life care plan to fully protect you.

There are different considerations depending on whether you were hurt in a car accident or on the job. Of course, there are some cases that involve both claims when someone is injured in a car accident while working.

Medical Costs for Car Accidents

For car accident cases, having future medical costs assessed is crucial because you only get one bite at the apple and you cannot leave your claim open to have future medical treatment paid for by the insurance company. Typically, there is one settlement in a car accident case (although there may be multiple layers of payment depending on whether the injured person has under-insured motorist coverage). If one of our car accident clients has future treatment needs for his or her accident-related injuries, the primary factor we look at in deciding on whether to get an expert to assess future medical costs is the amount of available insurance coverage for the case. If someone has significant injuries and future treatment needs but there is only $50,000 of coverage available, it wouldn’t make sense to spend money getting a future medical costs projection or life care plan done.

Medical Costs for Work Injuries

In a workers’ compensation case, the issue of future medical costs is a little more nuanced because South Carolina’s workers’ compensation laws do allow an injured worker to keep their workers’ compensation medical coverage for their work injuries intact. However, many of our clients prefer to settle their claim in its entirety (which involves giving up their future medical coverage). These complete settlements are referred to as “clincher” settlements. Obviously, a workers’ compensation insurance company will pay more money for a clincher settlement, as opposed to a settlement that leaves future medical coverage intact. Another consideration that leads some injured workers to give up their future medical coverage is that South Carolina law allows the workers’ compensation insurance company to control which doctors treat an injured worker. Often, our clients prefer to settle their workers’ compensation cases completely, giving them the flexibility to choose their treating doctors in the future.

Life Care Plans and Medical Cost Projections

When it’s decided that our client’s future medical costs warrant an expert’s opinion, there are two options we can use. The first is to have a nurse consultant complete a medical costs projection. Compared to life care plans, these projections tend to be less expensive (typically $1,000 or less). However, there can be evidentiary challenges to the use of these projections in civil cases. Because the evidentiary standard tends to be lower for workers’ compensation cases, the medical costs projection is typically what is used for a work injury case. There are times when we also use a medical costs projection in a car accident case when the available insurance coverage is limited.

By comparison, a life care plan is a more comprehensive assessment of the injured person’s future needs related to their serious injuries. These plans don’t just cover future medical costs but also include other economic losses, such as the need to hire someone else to complete tasks like yard work or provide assistance to the injured person. Life care plans are prepared by a certified life care planner. Certification is typically provided by the Certified Nurse Life Care Planner Certification Board or the International Commission on Health Care Certification.

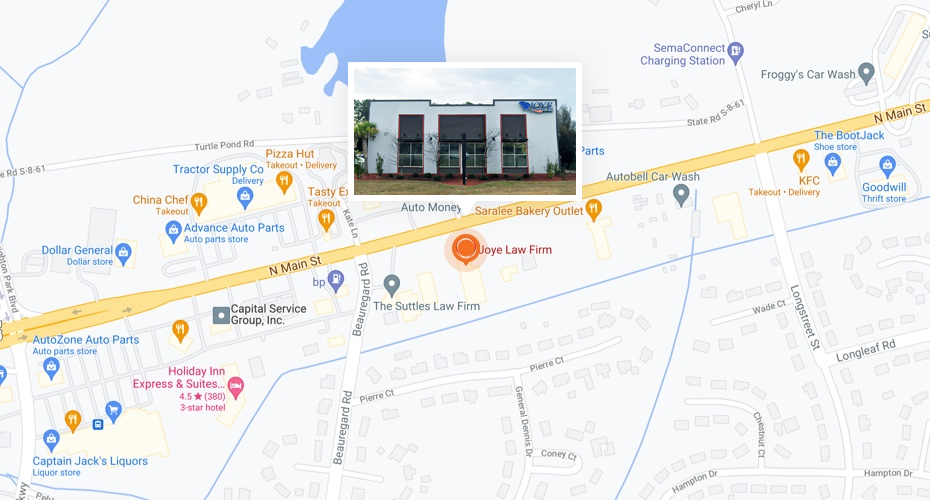

At the Joye Law Firm, we have worked with several well-qualified life care planners over the years. Many of these life care planners do not reside in South Carolina. The nature of the client’s injuries is a key factor in deciding which life care planner to use. Many of them specialize in handling specific types of injuries, such as brain or severe burn injuries. The cost of a life care plan can vary greatly depending on how complex the client’s medical situation is. While the standard cost is typically in the range of $3,500 to $5,000, it is not uncommon to see some plans cost $10,000 or more in a complex case. If you’ve been severely injured, hiring a well-established law firm with the financial wherewithal to fully prosecute your case is very important. You don’t want to have a lawyer taking shortcuts on fully developing your case because of cost considerations.

Seriously injured? When choosing a lawyer, make sure you hire a law firm with a track record of protecting its clients on all elements of damages, including future medical costs.