If you have purchased a new car or truck or leased a vehicle, you should consider obtaining GAP insurance on that vehicle.

If your vehicle is totaled in an accident, GAP insurance covers the difference between what the vehicle is worth after the accident and what you still owe on it. Collision and comprehensive coverage payouts are based on the car’s depreciated value, which in a single year can be as much as 20% less than what the vehicle was worth when you bought it.

Without GAP insurance, which stands for guaranteed asset protection coverage, you could be left paying off an auto loan for a car that is sitting in the junkyard. That can create financial stress when you need to replace the wrecked car.

How Does GAP Insurance Work?

GAP insurance pays when the amount left on a car loan or lease is greater than the value of your vehicle at the time the insurance adjuster declared it a total loss. It is coverage worth having if you are leasing a car or you owe more on a loan than your vehicle is worth.

Typically, when you buy a new car, your lender will require you to obtain comprehensive and collision insurance. Collision pays up to the value of the vehicle if you are in a crash. Comprehensive insurance pays the same for damage done by vandalism, theft, weather, hitting an animal, or other causes outside of a traffic accident.

While Collision and Comprehensive coverage are useful, the value of a new car drops constantly from the time it leaves the car lot. The nonprofit Insurance Information Institute (III) says most new cars lose 20% of their value within a year. A study by iSeeCars.com, an automotive research firm and vehicle marketplace, found that the average depreciation rate for a new car after five years was 40% in 2021.

NerdWallet sketches out what to expect from insurance if your car is stolen and you owe $30,000 on a car loan for that vehicle with a depreciated value of $25,000. After a $500 deductible, comprehensive insurance would pay you $24,500. After applying that to your car loan, you would still owe $5,500.

Guaranteed asset protection coverage, if you have that type of insurance, would pay that $5,500 gap between what your car was worth and what you owe on your car loan.

Without GAP insurance, you’d have to cover the balance on your car loan, as well as the cost of replacing your vehicle, out of your own pocket. New car replacement coverage would provide the money necessary for a new vehicle. Some insurers sell gap coverage and new car replacement coverage together.

You’d typically buy GAP coverage as an add-on to required auto insurance coverage when you lease or finance a new vehicle. Some insurance companies will sell GAP coverage as late as 12 months after the vehicle purchase or after you’ve driven up to 15,000 miles.

What Are the Benefits of GAP Insurance?

If you owe more than your car is worth and would not be able to come up with the difference out of pocket if your car was totaled, you should consider buying gap coverage. Check a site like Edmunds or Kelley Blue Book for an idea of what your car is worth.

The Insurance Institute suggests considering gap insurance when you buy a new car or truck if you:

- Put less than 20% of the purchase price down

- Financed for 60 months or longer

- Leased the vehicle

- Bought a vehicle that depreciates faster than the average

- Rolled over debt from an old car loan into the new loan

GAP insurance costs about $200 to $700 for the life of your automobile loan, depending on the dealer, lender, and state, according to the insurancequotes.com brokerage. You can usually roll GAP insurance payments into your monthly car payments.

The main benefit of GAP insurance is that it could potentially save you a lot of money if your vehicle is wrecked. Most GAP policies protect new and used vehicles valued up to $100,000 and losses up to $50,000. GAP policies sometimes cover insurance deductibles up to $1,000.

Because GAP insurance is intended only for the life of your car loan, you can request a refund of the remaining premium payments if you trade in your vehicle or pay off your loan early.

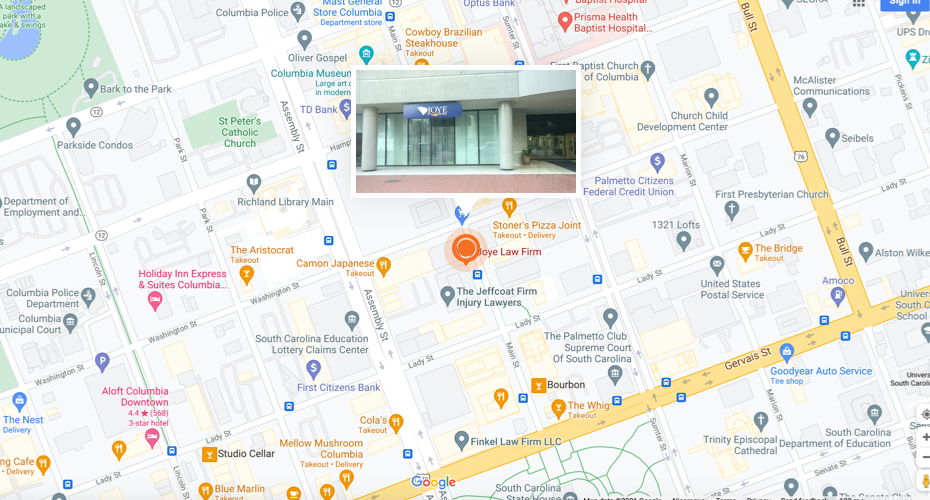

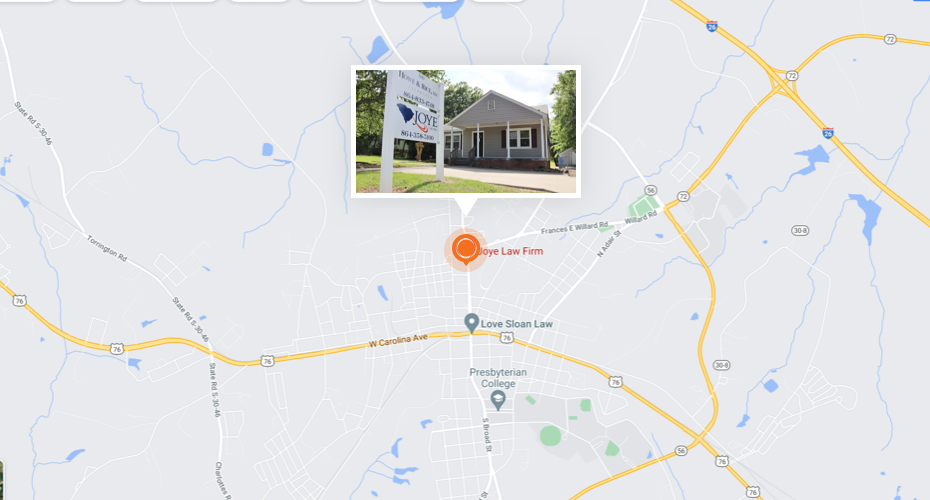

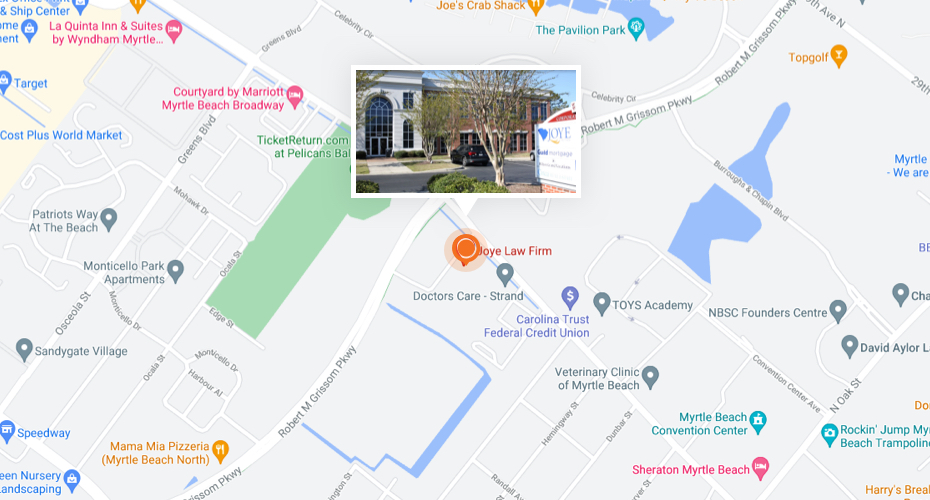

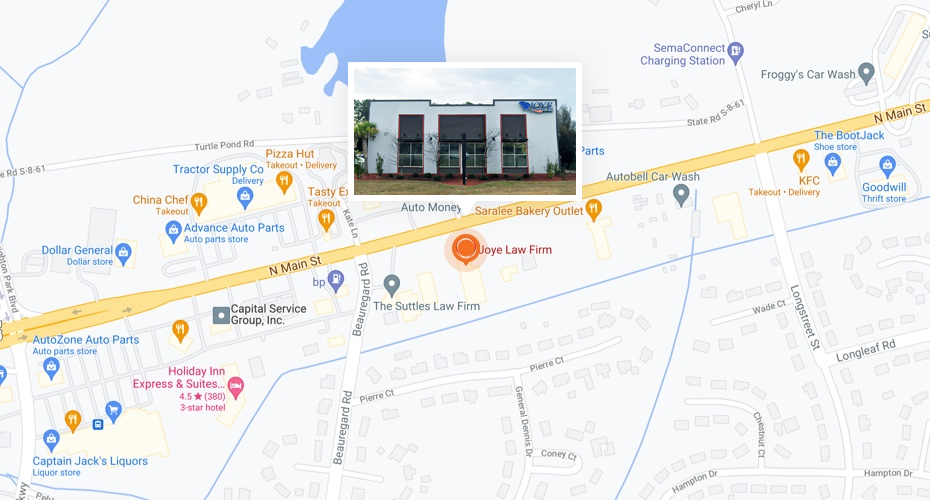

Call Our Joye Law Car Accident Attorneys

Repairing or replacing a damaged vehicle is one of many issues you’ll face after a car accident. At Joye Law Firm, our car accident attorneys work to help car accident victims seek insurance settlements that pay for their medical costs, vehicle damage or replacement, lost income, and pain and suffering. Our goal is to have a positive impact on the life of each client we serve.

Our primary objective is to help make you financially whole after a crash caused by another motorist. Having GAP insurance can help a car owner avoid being stuck with payments on a vehicle that has been totaled in a collision or stolen.

We care about our clients and want to put our legal experience to work for you if you’ve been hurt in any kind of accident caused by another driver. Let us review the details of your car accident-free of charge and discuss your legal options to move forward. Phone us at 888-324-3100 or contact us online today.