As a South Carolina personal injury attorney dealing with car accidents, you get really familiar with auto insurance and the different coverages available for South Carolina motorists to buy. So, it come as no surprise that clients, friends and family often ask us, “What kind of car insurance do I need to buy?” One thing we often recommend is that they obtain Personal Injury Protection (PIP) automotive insurance, which is sometimes called Medical Payment or MedPay coverage.

PIP insurance provides no-fault coverage, meaning you can use it to pay your medical bills for injuries suffered in a car accident, even if you were at fault. In addition to the policyholder, PIP covers the car’s passengers and anyone driving the vehicle for injuries suffered in a collision. PIP also pays out if the policyholder is injured by a car in a pedestrian accident or on a bicycle. This is important, as South Carolina is one of the most dangerous states for pedestrian and cyclist accidents.

How Is Personal Injury Protection (MedPay) Different from Bodily Injury Coverage?

By law, automobile owners in South Carolina must have bodily injury liability auto insurance coverage. Personal Injury Protection is optional insurance coverage in South Carolina, but PIP coverage is helpful to have because the state’s minimum requirements for auto liability coverage are low.

In a car accident that someone else causes, you’d seek payment for your injuries and property damage from the at-fault driver’s liability insurance. Claims for bodily injury may include medical expenses, lost wages, and pain and suffering.

South Carolina requires car owners to carry a minimum of $25,000 per person for bodily injury, $50,000 for all persons injured in one accident, and $25,000 for property damage. If you’ve been seriously injured, your medical expenses could quickly exceed $25,000. HealthCare.gov says the average cost of a three-day hospital stay is around $30,000.

If you have PIP coverage, you can tap it when the at-fault driver’s liability coverage runs out, or if you cannot get the at-fault driver’s insurance company to pay, in which case you should also contact a lawyer.

If the driver who hit you is uninsured, as 10 percent of S.C. motorists were in 2022, you would turn to your uninsured motorist coverage for compensation. South Carolina law requires drivers to carry uninsured motorist insurance with coverage equal to the minimum amount of liability coverage. There is typically a $200 deductible. But you could also tap your PIP coverage, if you have it, to augment the payout from your uninsured motorist coverage.

What Does Personal Injury Protection Cover?

As you’d expect, PIP policies cover medical care if you have been injured – including ambulance services, surgery, hospitalization, medication and medical supplies, x-rays, rehabilitation, prostheses, and even dental and optical care and chiropractic services.

PIP insurance will also cover lost wages incurred while you were recovering from your injuries and pay for help with household chores, such as cleaning and yard work, and for childcare.

Some PIP policies provide a death benefit to the policyholder’s family, which may be applied to funeral expenses.

Personal Injury Protection does not cover damage to your vehicle or any other property damage in a car accident.

PIP/MedPay – No Impact on Liability Insurance Recovery

Another benefit of having PIP insurance in South Carolina: there’s no subrogation of your claim against the at-fault driver’s insurance.

Subrogation refers to when one party takes on the legal rights of another. In personal injury claims, an insurance company will often claim it has a right to money a policyholder might eventually recover from another source for injuries the insurer has already paid to cover. But PIP carriers are not allowed to subrogate claims in South Carolina.

A similar provision of most insurance policies is the insurer’s “setoff” or “offset” rights. This allows the insurer to reduce its payment by subtracting the amount from its payout equal to what a policyholder receives from another source.

For example, in a car accident that happened while the injured driver was working at their job, the auto insurer might claim a setoff equal to the workers’ compensation payments the injured employee recovered. This is not allowed under PIP policies in South Carolina, either.

SC Code Section 38-77-144, which states that PIP is not required in South Carolina, also says, “If an insurer sells no-fault insurance coverage which provides personal injury protection, medical payment coverage, or economic loss coverage, the coverage shall not be assigned or subrogated and is not subject to a setoff.”

This means that if you have Personal Injury Protection coverage, you can recover all of the compensation you have paid PIP insurance premiums to have after a car accident as well as the compensation an at-fault driver owes you and may be compelled to pay you through a personal injury lawsuit.

Get in Touch with Our South Carolina Car Accident Attorneys

As car accident attorneys, we seek to hold auto insurers accountable to have them pay injured South Carolinians the compensation they are due by law.

If you have been injured in a car accident in South Carolina and are having trouble obtaining the insurance payout you are owed, contact Joye Law Firm to discuss your claim. If you have been seriously injured in an accident that was not your fault, you should contact us right away for help seeking the full amount of compensation you are due.

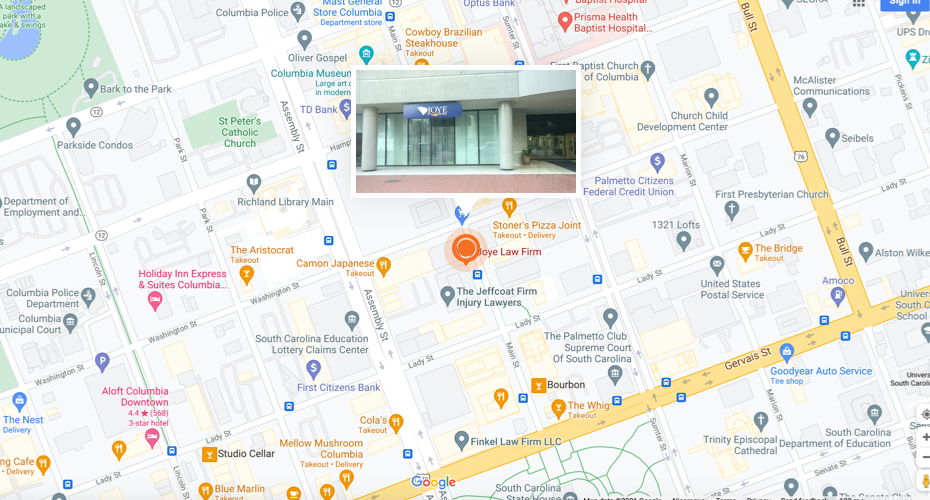

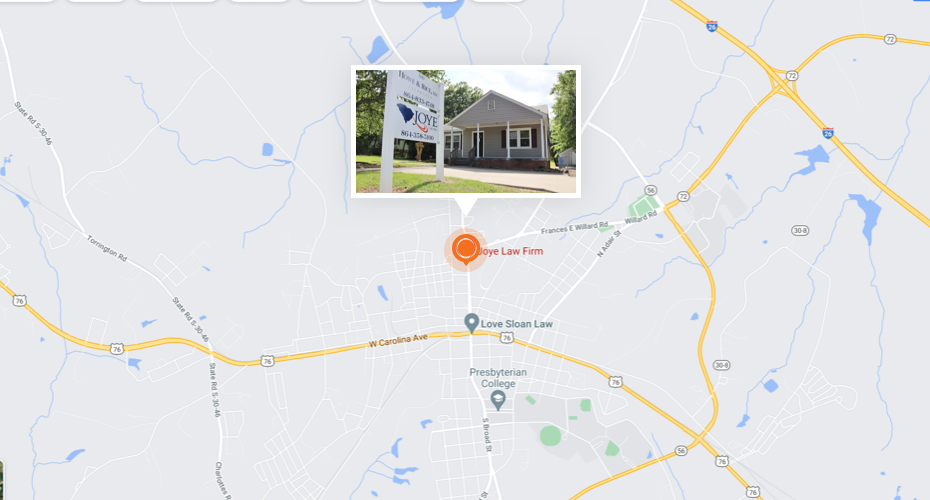

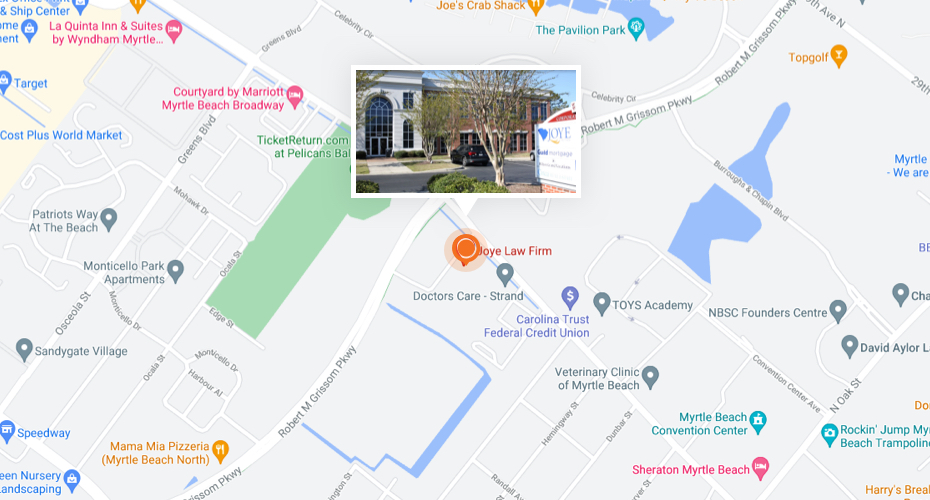

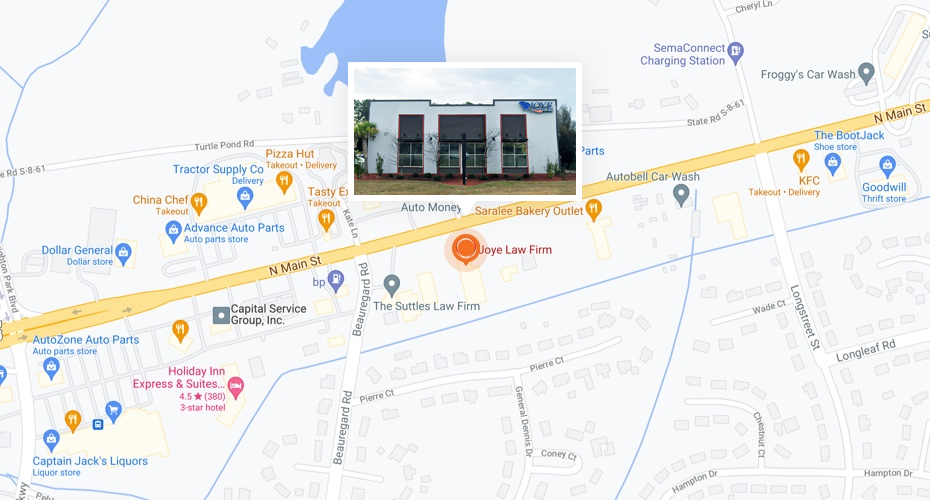

Contact us online or at 888-324-3100 today for a free, no-obligation initial consultation. We have offices in Charleston, Columbia, Clinton, Summerville, and Myrtle Beach and take cases from across South Carolina.