In the aftermath of an accident, the last thing you should worry about is navigating the complexities of insurance claims. Whether you’ve been in a car crash, truck accident, slip and fall, or another type of accident, physical and emotional recovery are your top priorities.

One of your biggest questions might be whether you should deal with the insurance company yourself or hire a lawyer. The short answer is simple: you should always talk to a lawyer if you’ve been in an accident with injuries. Talking to a South Carolina personal injury lawyer at Joye Law Firm can help ensure your rights are protected and you receive the compensation you deserve.

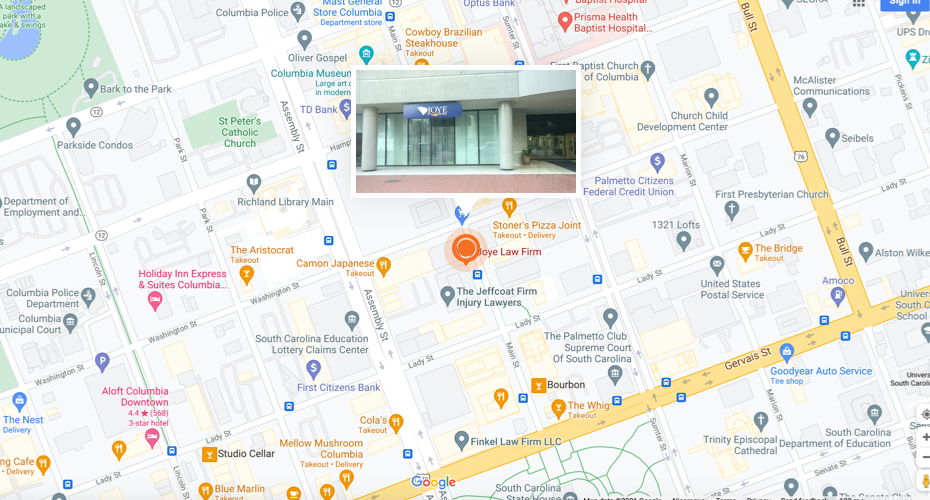

The insurance company might not have your best interests at heart. Its goal is to settle claims quickly and for as little money as possible. At Joye Law Firm, we believe insurers should hold up their end of the bargain and pay out claims quickly and fairly. Since 1968, our personal injury lawyers have been forcing them to do just that. We’ve helped thousands of South Carolinians navigate some of the most challenging times in their lives. Let us help you, too.

What to Avoid Saying to the Insurance Company

You will likely talk to an insurance adjuster to make the initial claim after an accident. There are certain things you should avoid saying to protect your claim. Here’s a list of things to keep in mind:

- Do Not Admit Fault: Never admit fault for the accident, even if you think you might be partially responsible. Determining fault is often a complex issue, and admitting fault can harm your claim.

- Avoid Speculating: Stick to the facts and avoid speculating about what happened or the extent of your injuries.

- Do Not Downplay Your Injuries: Be honest about your injuries and their impact on your life. Downplaying them can lead to a lower settlement offer.

The best idea is to say as little as possible and let your lawyer handle these communications. A seasoned personal injury attorney has experience negotiating with insurance adjusters and is familiar with their tactics to lowball settlement offers. Talk to your lawyer and let them talk to the insurer.

What Tactics Might an Insurer Use to Devalue Your Claim?

Insurance companies might use several tactics to reduce the value of your claim. Knowing these can help you avoid pitfalls and protect your right to fair compensation. Some common tactics include:

- Downplaying Injuries and Disputing Medical Claims: They might argue that your injuries are not as severe as you claim or they were pre-existing. They may even try to convince you that you should end your treatment early.

- Shifting Blame: They might suggest that you were at fault for the accident to reduce their liability.

- Pressuring You to Settle: They might pressure you to settle quickly, often before you understand the full extent of your injuries or the long-term costs.

In other situations, an insurer might misrepresent the amount of insurance coverage available or how a policy can be used. These tactics are designed to minimize the amount they have to pay.

Our attorneys are well-versed in dealing with the shady tactics insurance providers and their defense attorneys will use to escape liability, check out our track record:

- After a fire devastated North Charleston non-profit, Metanoia’s plans to rebuild the Old Chicora School, they turned to their insurance provider to recover the costs of the damages. Initially, the organization’s insurance denied their claim and unilaterally canceled their policy. Attorney Mark Joye took on the case pro bono and filed a lawsuit in federal court for the breach of contract and acting in bad faith. Mark fought doggedly until he secured a confidential settlement that would allow them to continue its transformative work.

- In another case, Attorney Joye represented two sisters who faced a long road to recovery after they were passengers of a reckless driver who ran off the road, crashing into a tree. The defendant’s insurance provider initially claimed there was $3 million available in coverage, then later asserted it was only $2 million. Atty. Joye painstakingly reviewed the insurance contracts and determined the policies totaled $3 million. “The tricks that the insurance company and defense attorneys played in this case were some of the worst I’ve experienced in 33 years,” says Atty. Joye. He ultimately recovered 2.41 million dollars for the sisters to cover their extensive medical treatment and recovery.

A free consultation with a lawyer at Joye Law Firm can help you navigate these challenges and ensure your claim is taken seriously.

Why Does the Insurance Company Want to Settle Quickly?

Insurance companies are in the business of making money. When they settle claims quickly, they often pay less than the claim’s true value. This can leave you without the funds you need for medical bills, lost wages, and other expenses related to your accident.

Settling quickly benefits the insurance company because they can talk you into a reduced payout. The faster they settle, the less likely you are to fully understand the extent of your injuries or the long-term impact on your life. While settling quickly might seem appealing, many injuries can worsen over time. Remember, you only get one chance to recover compensation. If you settle before knowing the full extent of your injuries, you may end up covering these bills out of your own pocket.

Insurance companies aim to settle quickly to prevent you from consulting a lawyer who might advise you to seek a higher settlement. They want to avoid dealing with strong negotiators or going to court.

What Role Does Technology Like Social Media Play in Insurance Claims After an Accident?

Social media can significantly affect your insurance claim. Insurance adjusters often look at your social media profiles to find evidence that can be used against you. We always advise our clients to stay off social media after an accident. Here’s how social media can impact your claim:

- Photos and Posts: Pictures of you engaging in activities that contradict your injury claims can be used to argue that you’re not as hurt as you say, even if the photos don’t show the whole story.

- Comments and Updates: Even seemingly innocent comments or updates about your day can be taken out of context to undermine your claim.

To protect yourself, avoid posting about your accident or injuries on social media. Instead, let your lawyer handle the communication with the insurance company, and don’t overshare in the virtual world.

Common Missteps to Avoid After an Accident

Amid the confusion and stress after an accident, it’s easy to make mistakes that can negatively impact your insurance claim and potential compensation. Being aware of these common missteps can help you protect your rights and ensure you receive the support and compensation you deserve.

Delaying Medical Treatment

One of the most significant mistakes you can make after an accident is delaying medical treatment. Even if you feel fine or believe your injuries are minor, you should seek medical attention immediately. Some injuries, like whiplash or internal bleeding, may not be immediately apparent. A medical professional can identify and document these injuries early on.

Prompt medical treatment also creates a documented timeline of your injuries, which is essential for your claim. Insurance companies may argue that delayed treatment indicates your injuries are not severe or were not caused by the accident.

Early treatment can prevent minor injuries from becoming more serious and can expedite your recovery process. By seeking medical attention promptly, you protect both your health and your legal rights.

Failing to Report the Accident to the Police

Another critical mistake is failing to report the accident to the police. While police reports are not admissible evidence in court, they do serve as an official record of the incident and can provide invaluable information about your accident.

The police report includes details about the incident, statements from involved parties and witnesses, and the officer’s observations. This official record can be crucial evidence for your claim. The police report can help establish who was at fault, which is essential for determining liability and pursuing compensation.

In South Carolina, you are legally required to report accidents that result in injury, death, or significant property damage. At the scene of a crash, the responding officer will give you an FR-10 insurance verification form. This form must be submitted to the South Carolina Department of Motor Vehicles within 15 days of the accident. Failing to do so can result in penalties and complicate your claim process. Always ensure you report the accident to the police, even if it seems minor at the time.

Accepting the First Insurance Settlement Offer

Accepting the first settlement offer is a common mistake that can leave you under-compensated. The first offer is typically made before the full extent of your injuries and damages are known. Accepting it may result in insufficient compensation for ongoing medical treatment, lost wages, and other long-term impacts.

Initial offers are usually low to save the insurance company money. There is often room for negotiation, and a lawyer can help you understand the true value of your claim and advocate for a fair settlement. Accepting a settlement usually means you waive your right to pursue further compensation. If your injuries worsen or you incur additional expenses, you won’t be able to seek more funds.

Not Contacting a Lawyer

Failing to contact a lawyer after an accident is a significant mistake that can negatively impact your claim. Consult a lawyer before accepting any settlement offers to ensure you receive the compensation you need and deserve.

A lawyer can provide professional advice on the steps to take after an accident, ensuring you don’t make costly mistakes. Attorneys are skilled negotiators who can deal with insurance companies on your behalf, helping to secure a fair settlement. Understanding the intricacies of personal injury law is essential for maximizing your compensation. A lawyer can navigate these complexities and protect your rights.

By being aware of these pitfalls and seeking legal advice, you can protect your rights and work towards securing the compensation you deserve. At Joye Law Firm, we are here to guide you through the process and ensure you make informed decisions every step of the way.

How Can Joye Law Firm Help You After an Accident?

Handling a claim on your own can be overwhelming. A lawyer can manage the legal aspects, allowing you to focus on your recovery. By getting a lawyer, you can ensure your claim is handled professionally and you have the best chance of receiving the compensation you deserve. Here’s how we can assist:

- Free Initial Consultation: We offer a no-obligation consultation to discuss your case and provide initial guidance.

- Thorough Investigation: If you agree to work with us, our team will investigate your accident, gathering crucial evidence to support your claim.

- Negotiations: We’ll handle all communications and negotiations with the insurance company, ensuring your rights are protected.

- Access to Resources: We have relationships with medical experts, accident reconstructionists, and other professionals who can strengthen your case.

- Trial Experience: As trial lawyers, we’re prepared to take your case to court if a fair settlement can’t be reached.

- Team Approach: Complex cases are reviewed by our full team of attorneys in case valuation meetings, ensuring we pursue maximum compensation.

- No Upfront Costs: Every Joye Law Firm client gets our No Fee Guarantee. Since we work on a contingency fee basis, you don’t pay unless we win your case.

Remember, your decisions immediately after an accident can have long-lasting impacts on your ability to recover fair compensation. By partnering with Joye Law Firm, you protect your rights and secure your future.

Understanding South Carolina’s Statute of Limitations

A statute of limitations is a legal time limit that sets a deadline for when you can file a lawsuit seeking compensation for your injuries. If you miss the deadline, you can forfeit your right to bring a claim and recover your losses. Here are the key points to remember:

- The general statute of limitations for personal injury claims in South Carolina is three years from the accident date.

- If you’re filing a wrongful death claim, the three-year countdown begins from the date of death, which may be different from the accident date.

- Claims against government entities may have shorter deadlines and additional notice requirements.

- In some cases, such as those involving minors or discovered injuries, the statute of limitations may be extended.

While three years might seem like a long time, building a strong case takes time. Evidence can disappear, witnesses’ memories can fade, and crucial documentation may become harder to obtain as time passes. We can ensure that all necessary steps are taken well before any deadlines, preserving your right to seek fair compensation.

South Carolina Negligence and Fault Laws: What You Need to Know

Understanding South Carolina’s negligence and fault laws can significantly impact your ability to recover compensation, including the amount you may be entitled to receive. South Carolina follows a modified comparative negligence rule.

This means that you can recover damages as long as you’re found to be 50% or less at fault for the accident. However, your compensation will be reduced by the percentage of fault attributed to you. If you’re found to be 50% or more at fault for the wreck, you’re barred from recovering any compensation from the other party. However, before you give up, let an attorney review your case. They might find evidence that reduces your fault and enables you to receive compensation.

In cases involving multiple at-fault parties, South Carolina uses a modified joint and several liability rules. This can affect how damages are apportioned and collected from various defendants.

Unlike some states, South Carolina is not a no-fault insurance state. This means you can sue the at-fault driver for damages, including pain and suffering, which aren’t typically covered under no-fault systems.

These laws can be complex and their application can vary depending on the specific circumstances of your case. You don’t need to worry about figuring this out yourself.

At Joye Law Firm, our team of trial lawyers has a deep understanding of South Carolina’s negligence and fault laws. We use this knowledge to build strong cases for our clients, ensuring that fault is clearly determined and that you receive the maximum compensation possible under the law.

Don’t Talk to the Insurance Company. Talk to an Experienced Personal Injury Attorney at Joye Law Firm

After an accident, you might feel pressured to handle things on your own. However, the insurance company is not on your side. They are looking to settle quickly and for as little as possible. Talking to a lawyer at Joye Law Firm can help ensure your rights are protected and that you receive the compensation you deserve.

Remember, you don’t have to go through this alone. Our team of experienced personal injury lawyers is here to help you every step of the way. Contact Joye Law Firm today for a free consultation and let us help you navigate the aftermath of your accident with confidence and peace of mind. Call our office at 888-324-3100 or contact us online.