Auto insurance in South Carolina is a legal necessity for drivers. It provides essential financial protection in the event of accidents. Since we get a lot of questions on this topic, we’ve put together this comprehensive guide, which will address questions like, “Why is car insurance so expensive in South Carolina?” and “Do I have to have car insurance?” By the end of this blog, you’ll better understand South Carolina car insurance laws, requirements, and options to protect yourself and your family.

Why is Car Insurance So Expensive in South Carolina?

South Carolina’s car insurance rates are based on several factors:

- High Accident Rates: South Carolina has the second most fatal car accidents per capita of any state in the U.S. South Carolina’s roads not only put lives at risk but also contribute to rising insurance premiums. Drivers who live within high-traffic areas are viewed as a greater risk by the insurance industry. Therefore, they get charged more for coverage.

- Uninsured Drivers: All South Carolina drivers are required to purchase both liability coverage and uninsured motorist coverage. Despite risks like steep fines, jail time and license suspensions, as many as 1 in 10 Palmetto State drivers don’t carry insurance. This puts pressure on the whole system and leads insurance companies to jack their rates in order to cover potential losses.

- Inflation: Auto insurance helps cover the costs of medical care and lost wages for injured crash victims, as well as the repair or replacement of damaged vehicles and property. However, as medical expenses and auto repair costs continue to rise, insurance premiums are also likely to increase.

- Extreme Weather: Some areas of South Carolina face natural disasters nearly every year. Living in a region prone to flooding and tropical storms increases the risk to both you and your vehicle.

- Demographics: Insurance companies keep a close eye on many factors, including the people who are statistically most likely to cause accidents. Because of this, they often charge young drivers and male drivers higher rates.

- Your Personal Driving History: When you attempt to buy insurance, the company will assess your driving record and accident history. The more flaws they find, the more they’ll charge you for premiums.

- The Insurance Company: Like any other service provider, rates vary greatly from company to company. It’s important to get quotes from several agencies before making a purchase. This will ensure you get the best deal possible.

Want to learn more about what makes car insurance rates increase? Read this blog to examine why this has happened and what you can do about it.

What are the Minimum Auto Insurance Requirements in South Carolina?

South Carolina requires all drivers to carry a minimum amount of liability insurance coverage to operate a vehicle legally. This insurance protects other drivers if you damage their vehicle or cause them to suffer bodily injury in a crash. South Carolina law requires that you carry liability coverage in the following minimum amounts:

Minimum Liability Coverage (or 25/50/25 coverage):

- $25,000 bodily injury coverage per person

- What this means: Insurance will cover medical expenses for someone injured in a crash, up to the policy limit. For bodily injury liability, the minimum insurance policy pays out up to $25,000 per person, but caps at $50,000 per crash, regardless of how many people were injured. If medical expenses exceed these limits, the at-fault driver is responsible for the remaining costs. For example, if you cause an accident that results in $35,000 in medical bills for the other driver, your insurance pays $25,000, and you could be forced to pay $10,000 out of your own pocket.

- $50,000 bodily injury coverage per accident

- What this means: Insurance will pay up to this much in medical expenses for people injured in the crash. This amount also overrides the “per person” amount. That means if three people were injured and they all had $25,000 worth of injuries, insurance would not pay $75,000; it would only pay $50,000.

- $25,000 property damage per accident

- What this means: Insurance covers damages you cause to others’ property in a car accident, including vehicle damage, personal property inside the vehicle, and other physical property like buildings or fences. The minimum coverage pays up to $25,000 for all property damage combined. For example, if the other driver’s expensive smartphone is damaged in the crash, they could request compensation to replace it. Like bodily injury, you have to personally pay for property damage exceeding this amount.

Uninsured Motorist Coverage (UM):

The state also requires drivers to carry uninsured motorists (UM) insurance with the same 25/50/25 minimums as liability insurance and typically a $200 deductible. UM protects you or your passengers in an accident caused by uninsured drivers, including hit-and-runs. The payouts are the same as the liability coverage: $25,000 for one person’s medical bills, $50,000 for multiple people’s medical bills, and $25,000 for property damage.

Since you don’t know who the at-fault driver is in a hit-and-run, you cannot file a claim for compensation with their insurance carrier, so you must go through your own. In this case, your insurance company may charge you the deductible before paying you out of your UM insurance.

If the at-fault motorist is ever found, your insurance provider should reimburse you for the deductible.

Options for More Coverage

While not legally required, getting more insurance coverage than the minimum is smart. Auto accidents cause serious damage to property and expensive injuries to the people involved. The average 3-day hospital stay in the United States costs over $30,000, which is already $5,000 out of your own pocket if you have minimum coverage and injure someone in an accident.

- Underinsured Motorist

Underinsured motorist (UIM) is an optional but highly recommended coverage that protects you if you get into a crash with a driver whose insurance doesn’t cover all your damages. UIM pays the difference between the at-fault driver’s insurance limits and the total amount of your damages – up to your policy’s limits. For example, you’d use this if the at-fault driver’s coverage is $25,000 worth of bodily injury liability coverage, but you have $30,000 in medical bills. UIM would cover the remaining $5,000. While insurance companies must offer UIM, you are not required to buy it. However, given the high medical costs and the fact that most people carry only minimum amounts of coverage, having UIM can provide essential financial protection. - Medical Payments (MedPay) or Personal Injury Protection (PIP)

Medical Payment coverage, sometimes referred to as Personal Injury Protection insurance, is a no-fault insurance option that helps pay for out-of-pocket medical bills and expenses after a car accident. It can prevent your bills from going out to collections and may increase your total compensation in the end. However, MedPay is usually only sold in small coverage amounts ($5,000 as opposed to $25,000, for example), so it shouldn’t be your only way of paying for crash-related medical bills! - Collision

This coverage pays for your car’s damages regardless of who is at fault. If you cause the crash, your insurance will pay for the repairs. If someone else is at fault, your insurance company may handle repairs upfront and seek reimbursement later. If you finance your car, the lender may require you to carry this insurance. - Comprehensive

This optional coverage will pay for damages that are not collision-related such as theft, vandalism, fire, falling objects like a tree branch or hail damage, or animal collision. The newer your vehicle, the more important this coverage becomes as repair costs can often exceed the car’s value. Without comprehensive coverage, you are left footing the cost on your own. - Gap

This coverage is an optional insurance policy that may help pay off the difference between the remaining balance on your lease or loan and your car’s ACV (actual cash value) if your vehicle is totaled. For example, you buy a new car for $20,000 and you still owe the bank $15,000 when it is totaled, even though its ACV has depreciated to $10,000. Your gap policy insurance can help cover the $5,000 you still owe on the vehicle, so you don’t have to come up with these funds out of pocket.

Should You Buy More Than the Minimum?

Yes, if possible. While meeting the minimum insurance requirements is essential, buying more than the minimum coverage can provide you with additional protection. Some reasons why you should consider purchasing more than the minimum insurance coverage include:

Protection for Your Assets

If you are at fault in an accident, your liability could quickly exceed your minimum insurance coverage limits. If this happens, you could be on the hook for the remaining costs, which may place your personal assets at risk. Purchasing additional liability coverage helps protect your assets and reduce your risk of financial hardship.

Protection Against Underinsured Drivers

If a driver with a minimum-limits policy hits you, you may be left with expenses their insurance policy doesn’t cover. Underinsured motorist (UIM) coverage pays for your injuries or property damage if the at-fault driver does not have enough insurance.

Protection for Your Vehicle

Comprehensive coverage options, such as collision and comprehensive coverage, can help protect your vehicle from damage caused by collisions, theft, weather events, and other incidents.

Protection for Yourself and Your Passengers

Personal injury protection (PIP) and medical payments coverage can help cover medical expenses and lost wages if you or your passengers are injured in an accident. Although PIP isn’t required in South Carolina, most insurance companies offer it.

Protection for Other Drivers and Their Property

Liability coverage is essential for protecting other drivers and their property if you are found to be at fault in an accident. By carrying higher liability coverage limits, you can ensure that you have adequate protection against potential damages and legal fees.

Protection Against Unforeseen Events

Additional coverage options, such as roadside assistance and rental car coverage, can help protect you in the event of unforeseen events, such as a breakdown or accident. These coverage options provide the support and resources needed to get back on the road quickly and safely.

Your Auto Insurance May Also Cover Additional Perks

Depending on the type of insurance you bought, you may also be entitled to other benefits from your auto insurance provider. For example, it’s common for insurers to offer some roadside assistance benefits or other crash-related expenses, such as:

- Paying for your vehicle to be towed to a repair shop

- Paying for a rental car while your vehicle is being repaired

- Emergency travel expenses (typically hotel and food) if your crash happens far from home

Some of these benefits may apply even after a breakdown unrelated to a crash. Make sure to check your auto insurance policy to see what is included.

What to Watch Out for in Auto Insurance Policies

Read the fine print of any auto insurance policy you currently have or are considering buying. Here are some important “red flags” you may find buried in the fine print:

- Stacking Exclusions

South Carolina law allows stacking. In other words, if an uninsured or underinsured driver hits you and you have more than one vehicle at home, you can add those vehicles’ policies together to cover your damages. However, some insurance companies play with their policy language to avoid stacking. - Offsetting

If you file an uninsured or underinsured motorist claim, the insurance company may try to avoid paying you amounts that have already been covered by another source such as workers’ compensation. However, not all these “offset” clauses will survive a court’s scrutiny. - Other Exclusions

When you review an auto insurance contract, you should focus on the exclusions section. For instance, look for what happens if you are injured while driving a vehicle you do not own. Also, look for how your insurance company defines a “non-owned vehicle.” Is it just rental cars? What about a friend’s vehicle? What if your employer asks you to run an errand at work?

Stacking: What You Need to Know About Your South Carolina Auto Insurance Policies

For minor motor vehicle accidents, typically the at-fault driver’s insurance covers the injured person’s damages. However, in cases involving serious injuries and extensive medical bills, the at-fault driver’s liability insurance coverage may quickly be exhausted. By purchasing underinsured motorist (UIM) coverage for all your vehicles, you can “stack” UIM coverage, combining the UIM limits on all your vehicles to better protect yourself and ensure full compensation for your damages should you be seriously injured in an automobile accident resulting from the negligence of another.

For example, a 35-year-old motorcyclist suffered a traumatic brain injury, spinal and rib fractures, and other severe injuries after an SUV failed to yield the right of way. His medical expenses exceeded $370,000, not including the 24-hour care, extensive rehab, and lost wages due to his inability to work. Attorney Sydney Lynn discovered the at-fault driver carried a $250,000 liability policy with a $1,000,000 umbrella policy, while the motorcyclist carried two UIM policies totaling $100,000. Through strategic negotiations with all three insurers, Attorney Lynn secured a $1.35 million settlement for our client, allowing him to focus on his recovery without worrying about his financial future.

Choosing the right insurance coverage is a personal decision, but adding underinsured motorist coverage for each of your vehicles is an affordable way to safeguard yourself from negligent drivers with insufficient liability insurance coverage. Auto insurance laws are complex, and determining the available coverage after an automobile accident can be challenging. Therefore, if you are seriously injured in an automobile accident due to the negligence of another driver, it is important that you seek the assistance of an experienced.

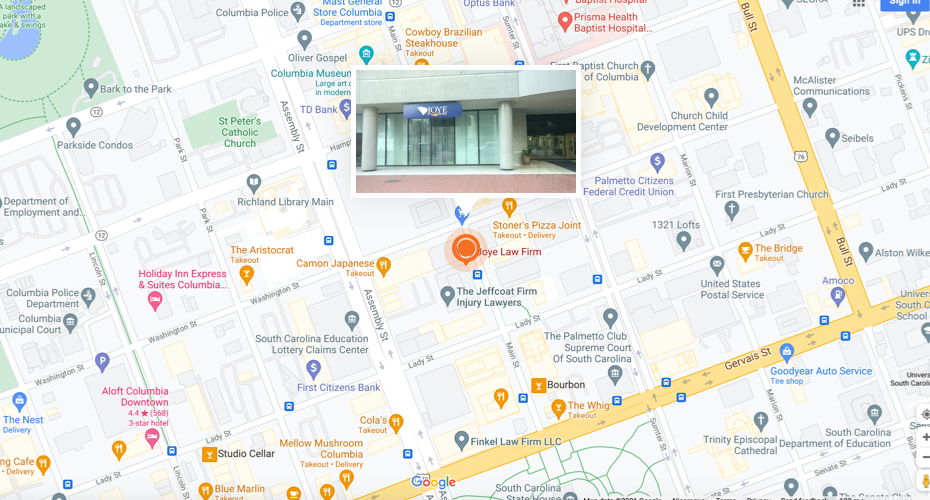

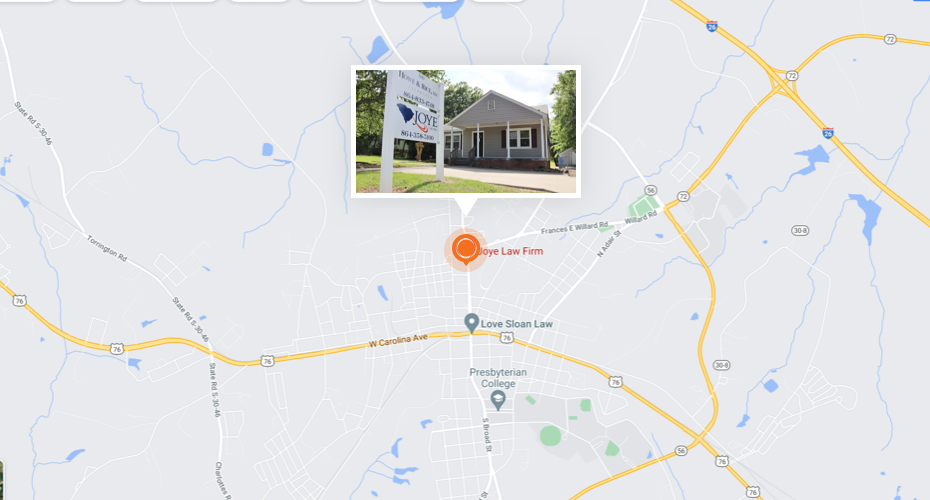

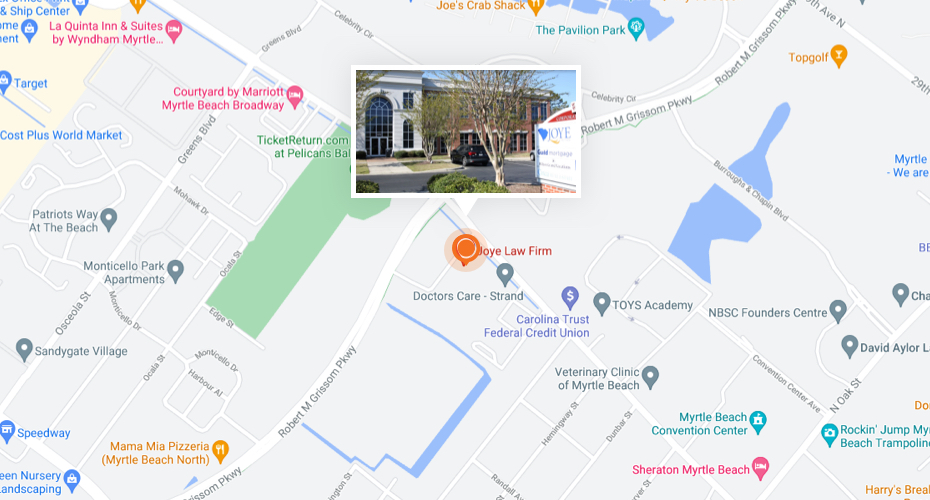

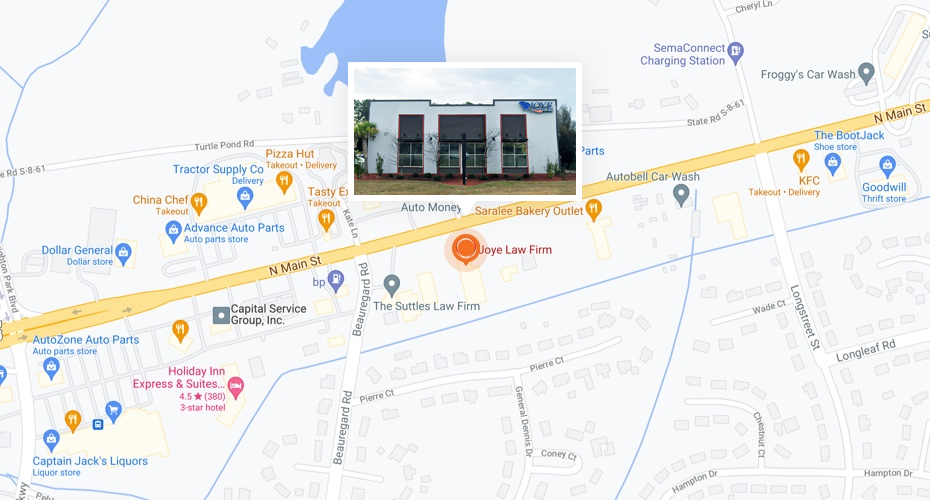

How The Car Accident Attorneys at Joye Law Firm Can Help You

Driving in South Carolina can be dangerous. So, it’s wise to carry more than the minimum required auto insurance coverage to protect yourself and your finances. If you’re involved in a car accident, especially one caused by another driver, contacting an attorney immediately is essential. Insurance companies, even with premium policies, often aim to minimize payouts, making it challenging to secure fair compensation on your own.

A car accident attorney can handle negotiations, gather necessary documents, and provide guidance, allowing you to focus on recovery. Since 1968, Joye Law Firm has been committed to helping clients recover after car accidents, whether they need help dealing with insurance companies or pursuing claims against negligent drivers. Contact Joye Law Firm for a free consultation to review your case and explore every avenue for compensation.