The screech of tires, the sickening crunch of metal on metal, and the jolt of impact—these are the hallmarks of a rear-end crash. These are some of the most common and potentially devastating types of car accidents in the United States.

As the dust settles and the adrenaline subsides, one question looms in the minds of those involved: “Who pays for the damages?” The answer is not always clear-cut, as liability in rear-end collisions can become complex and contentious.

Whether someone injured you in a rear-end collision or you simply want to prepare for the unexpected, this guide will provide you with the insights you need to handle the aftermath of a crash and how a South Carolina rear end accident lawyer can help you protect your rights.

Presumption of Fault in South Carolina Rear-End Collisions

In most cases, the driver of the rear vehicle is presumed to be at fault for a rear-end collision. This is because traffic laws require drivers to maintain a safe following distance and prepare to stop if the vehicle in front of them slows down or comes to a halt.

The belief is that if a rear-end collision occurs, the rear driver was either following too closely, not paying attention, or failed to react in time to avoid the crash.

However, exceptions apply to this general rule. In many cases, the lead driver may wholly or partially contribute to the wreck. Some examples include:

1. Sudden Stops

While rear drivers must maintain a safe following distance, the lead driver’s actions can contribute to a rear-end collision. If the lead driver slams on their brakes without a valid reason, such as stopping abruptly in the middle of the road to answer a text message or to pick up an item they dropped, they may bear some legal responsibility for the resulting crash.

In these cases, the specific circumstances of the accident, such as road conditions, visibility, and the speed of the vehicles involved, will be taken into account when determining liability.

2. Mechanical Issues

All drivers have a responsibility to maintain their vehicles in a safe, roadworthy condition. This includes ensuring that critical safety components, such as brakes and brake lights, function properly.

All drivers have a responsibility to maintain their vehicles in a safe, roadworthy condition. This includes ensuring that critical safety components, such as brakes and brake lights, function properly.

If the lead car has malfunctioning brake lights, the rear driver may not receive adequate warning that the lead vehicle is slowing down or stopping, increasing the risk of a crash.

Other mechanical problems that could potentially contribute to a rear-end accident include faulty turn signals, non-functioning hazard lights, or even a sudden engine stall that causes the lead vehicle to lose power and decelerate rapidly.

If it can be demonstrated that the lead driver knew or should have known about these mechanical issues and failed to address them, they may be held at least partially liable for the resulting accident.

3. Unexpected Reversing

Drivers have a duty to check their surroundings and ensure that it is safe to reverse before doing so. If the lead driver suddenly reverses their vehicle without warning, they may be found at fault for any resulting rear-end collision. We often see these types of collisions occur when someone backs out of a parking spot without looking or attempts to change directions on a busy road.

This is because the rear driver has a reasonable expectation that the vehicle in front of them will continue moving forward, and they may not have sufficient time to react to the sudden change in direction.

However, if the lead driver can demonstrate that they took appropriate precautions, such as using their turn signal or rear-view camera, and the rear driver still failed to respond in time, the liability may be split between the two parties.

4. Lane Changes

Unsafe lane changes are another common contributor to rear-end collisions. When the lead driver changes lanes abruptly or without signaling, they may catch the rear driver off guard and leave them unable to adjust their speed or position in time to avoid an accident.

Drivers must use their turn signals when changing lanes and ensure that it is safe to do so before initiating the maneuver. This means checking their mirrors, blind spots, and the speed and position of surrounding vehicles. If the lead driver fails to take these precautions and causes a rear-end crash, you can hold them responsible for the damages.

However, if the rear driver also engaged in negligent behavior, such as speeding, driving while distracted, or failing to maintain a safe following distance, they may share some of the fault for the accident.

In these cases, the comparative negligence rules of the state where the accident occurred will determine the allocation of liability and the amount of compensation available to the parties involved.

Comparative Negligence: What You Need to Know

In some cases, both drivers may share responsibility for the rear-end collision. This is known as comparative negligence. Under this legal concept, the fault is allocated between the involved parties based on their degree of negligence.

For example, if the lead driver is found to be 30% at fault for the accident due to a sudden stop, and the rear driver is found to be 70% at fault for following too closely, any damages awarded by the courts would decrease by the percentage of fault attributed to each driver.

It’s important to note that the laws regarding comparative negligence vary by state.

South Carolina uses a modified comparative negligence system, where a driver can only recover damages if their fault is less than 50%.

Insurance Coverage for Rear-End Collisions

Insurance coverage plays a crucial role in determining who pays for the damages. In most cases, the at-fault driver’s insurance company compensates the victim for their losses. This is why drivers need adequate liability insurance.

Insurance coverage plays a crucial role in determining who pays for the damages. In most cases, the at-fault driver’s insurance company compensates the victim for their losses. This is why drivers need adequate liability insurance.

Bodily Injury Liability

Bodily injury liability coverage pays for the medical expenses, lost wages, and pain and suffering of the other driver and their passengers. The costs associated with serious injuries can quickly add up to hundreds of thousands or even millions of dollars, making this coverage essential.

When purchasing bodily injury liability insurance, consider the minimum requirements in your state, your personal assets, and your potential risk exposure. In South Carolina, the minimum insurance requirements are often referred to as 25/50/25. This means you must carry $25,000 bodily injury coverage per person, $50,000 bodily injury coverage per accident, and $25,000 property damage per accident.

Property Damage Liability

This coverage pays for the repair or replacement of the other driver’s vehicle and any other property damaged in the accident if you are at fault.

If the at-fault driver does not have insurance or their insurance is insufficient to cover the damages, the victim may need to rely on their own insurance coverage. Some coverages that can help in these situations include:

Uninsured Motorist (UM) Coverage

Despite the legal requirement for drivers to carry liability insurance, not everyone follows the rules. In fact, according to the Insurance Research Council, nearly 11% of drivers in South Carolina do not carry insurance. Because of this South Carolina law requires drivers to carry an uninsured motorist policy that is equal to or greater than that state’s minimum requirements for liability coverage ($25,000/$50,000/$25,000). This coverage pays you if you suffered injuries or property damage caused by a hit-and-run or uninsured driver.

Underinsured Motorist (UIM) Coverage

Many South Carolina drivers carry only the minimum required liability coverage, which may not fully compensate victims in a serious accident. This is where underinsured motorist coverage comes in. It pays you for your injuries and property damage if the at-fault driver’s insurance policy isn’t large enough to cover your medical bills and other damages. While not required by law, it is highly recommended that you carry UIM coverage equal to or greater than the state’s liability minimums.

Collision Coverage

Collision coverage is another type of auto insurance that can help protect you in the event of a rear-end wreck. This coverage helps pay for the repair or replacement of your own vehicle, regardless of fault for the accident.

Without collision coverage, you may pay out of pocket for repairs to your own vehicle, even if the other driver damaged it. While the law does not require collision coverage, it may be required by your lender if you have an auto loan on your vehicle. Your lienholder may also require you to purchase comprehensive coverage to protect their investment from vandalism, fire, flood, and damage caused by animals or objects.

Medical Payments Coverage (MedPay) or Personal Injury Protection (PIP):

Medical payments coverage (MedPay), also known as personal injury protection (PIP) is an additional type of optional auto insurance that can help cover your medical expenses after a rear-end collision.

MedPay helps pay for your medical expenses, regardless of who is at fault for the accident. This coverage can pay for hospital bills, doctor visits, and other medical costs related to the crash.

MedPay/PIP can be a valuable addition to your auto insurance policy, providing added peace of mind and financial protection in the event of a rear-end collision.

Challenges in South Carolina Rear-End Collision Claims

While rear-end collisions may seem straightforward, you will encounter challenges when it comes to determining fault and obtaining fair compensation. Some common issues include:

-

Disputed Liability

In some cases, the at-fault driver may deny responsibility or claim that the other driver contributed to the accident. This can lead to a lengthy and complex claims process.

In a recent case, Attorney John Aylor of our Charleston office dealt with an at-fault driver who rear-ended his clients and then denied any wrongdoing. Read more about this case that resulted in favorable trial verdicts for his clients.

-

Low-ball Settlement Offers

Insurance companies may attempt to minimize their payout by offering a settlement that does not fully cover your damages. You need a clear understanding of your losses and to negotiate for fair compensation.

Attorney Brent Arant of our Charleston office helped a client recover a $1.7 Million settlement after being struck from behind by a negligent driver. The result was nine times the insurance company’s original low-ball offer.

-

Pre-existing Conditions

If you have pre-existing medical conditions that the accident aggravated, the insurance company may argue that your injuries are not related to the collision. This can make it harder to obtain compensation for your medical expenses.

Attorney Tommy Terrell of our Myrtle Beach office successfully negotiated a $450,000 settlement for a client who suffered a severe back injury after being rear-ended. Despite the client having a pre-existing back condition, an updated MRI served as the crucial piece of evidence that convinced the client’s UIM provider to pay out the policy limits.

-

Delayed Symptoms

Some injuries, such as whiplash or concussions, may not present symptoms immediately after the accident. If you settle your claim too quickly, you may not receive compensation for these latent injuries.

Attorney Robert Howell of our Charleston office recovered a $1,000,000 settlement for a client who was rear-ended by a reckless semi-truck driver. While our client was in immediate pain, he didn’t realize the extent of the damage until a few weeks later when an MRI revealed multiple disc injuries.

-

Uninsured or Underinsured Drivers

If the at-fault driver does not have insurance or has insufficient coverage, it can be more beneficial to turn to your own insurance for additional coverage. In these cases, you may need to rely on your own uninsured/underinsured motorist coverage or consider pursuing legal action against the at-fault driver.

Attorney Jeff Gerardi of our Summerville office represented a veterinarian who suffered a career-ending injury in a car accident. The driver who caused the accident only carried the minimum liability insurance coverage. Although the victim had a $300,000 UIM policy, her insurer initially declined to cover the crash. By highlighting the devastating impact of the accident on his client’s career, Gerardi successfully recovered the full $300,000 UIM policy limits.

The Role of a Car Accident Attorney in Rear-End Collision Claims

The insurance claim process after a rear-end collision can be complex and overwhelming, especially when dealing with injuries and property damage.

An experienced personal injury attorney who handles car accident claims can help you with:

- Investigate the accident: An attorney can gather evidence, interview witnesses, and consult with experts to build a strong case on your behalf.

- Determine liability: Your car accident attorney can analyze the evidence and help determine who is at fault for the crash, even in cases where liability is disputed.

- Calculate your damages: A lawyer can help you assess the full extent of your losses, including medical expenses, lost wages, property damage, pain and suffering, and future needs.

- Negotiate with insurance companies: Your car accident lawyer can communicate with the insurance companies on your behalf and work to negotiate a fair settlement that properly covers your losses.

- Represent you in court: If a fair settlement cannot be reached, your attorney can represent you in court and fight for your rights.

Talk to a Car Accident Lawyer About Your Case Today

After a rear-end collision, take the necessary steps to protect your rights and ensure a smooth insurance claim process.

In car accident cases involving significant injuries or property damage, or when the other party disputes liability, consult an experienced South Carolina personal injury attorney.

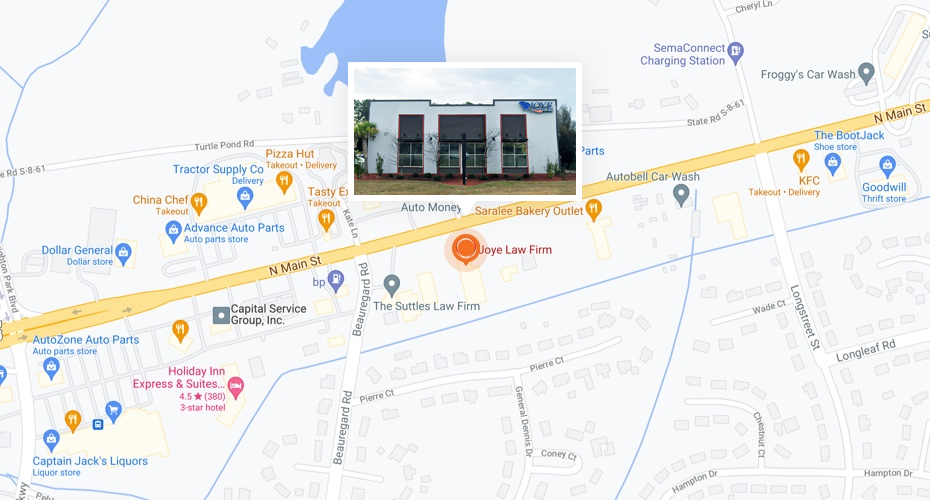

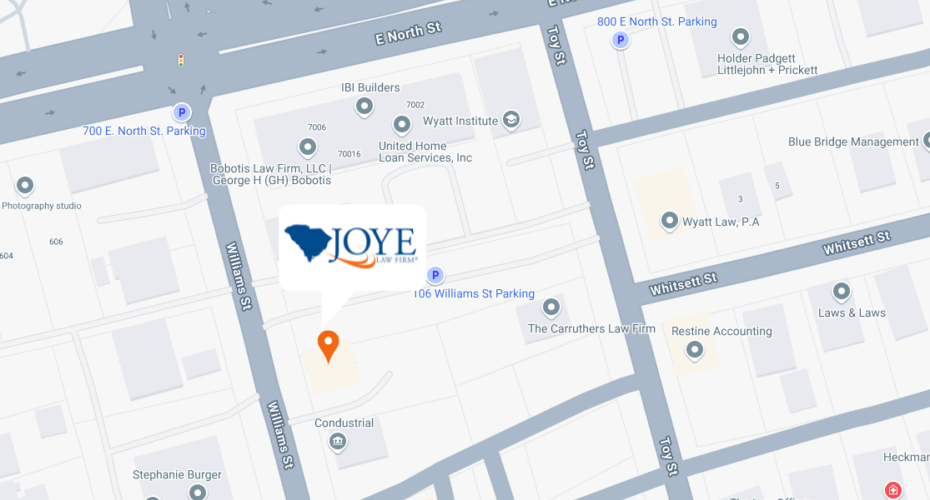

That’s where Joye Law Firm comes in.

Don’t let the stress and uncertainty of a rear-end collision claim consume your life. Let the experienced South Carolina car accident lawyers at Joye Law Firm shoulder the burden for you, so that you can focus on your recovery and moving forward with your life. We’ve been helping people just like you since 1968.

Contact us today for your free, no-obligation consultation by calling (888) 324-3100 and discover how we can help you pursue the justice and compensation you deserve.