Many apartment complexes require residents to purchase renters insurance in order to live there. However, unlike car insurance, renters insurance may be contractually required but it isn’t legally required. There’s no law that says you need to purchase it, so many people, when given the option, choose not to do so in order to save money on their monthly budget. In fact, 37% of renters go without, according to the Insurance Information Institute.

However, there are several very good reasons why you should purchase renters insurance, which we’ll go over today.

Renters Insurance Protects Your Property

Many people may believe they don’t need to purchase renters insurance because they are protected under their landlord’s insurance. This may be true for the building you live in, but it doesn’t apply to your personal belongings.

You may also believe that you don’t own anything valuable enough to be worth insuring, and while that may be true for any single item, the entirely of your belongings is likely a completely different story.

When combining the total cost of furniture, clothing, kitchen items, and personal electronics such as phones, laptops, televisions, gaming systems, and so on, renters insurance provider Allstate estimates that the average two-bedroom apartment in the U.S. contains roughly $30,000 worth of belongings.

If your apartment or rental home was damaged in a fire, the landlord’s insurance would only pay to repair their property, i.e., the building. Meanwhile, without renters insurance, you would be personally responsible for replacing everything you own. With renters insurance, you will receive compensation for your damaged property as well as money to put you up in a hotel, and usually food and transportation expenses as well, until your home is habitable again or you find a new place to live.

Most renters insurance policies also cover burglary, even if your belongings weren’t stolen from your home. For instance, if your laptop was stolen from your car or at a café, it may be covered under your renters insurance policy.

Many renters insurance policies will even pay the replacement value for your items rather than their actual value. This means that you would receive the $1,000 it would take to buy a new couch and not just the $100 your couch was worth after 10 years of use.

Renters Insurance Protects You From Personal Liability

If you are willing to take the risk on your personal property, then the more important reason to purchase renters insurance is that it can prevent you from being sued if someone is injured in your home.

At Joye Law Firm, we deal with many cases where people are accidentally injured when slipping and falling not only in stores and other businesses, but also in private residences. When this occurs, your injured visitor will need compensation to cover their medical expenses, and when you have renters insurance, this compensation will come from the insurance company rather than your bank account.

Renters insurance can also protect you from personal liability if your dog bites someone, even if it happened at the park and not at home. Roughly 4.5 million people are bitten by dogs each year in the U.S., according to the American Pet Products Association, and about 885,000 of those bites require medical attention. If your dog bites someone and seriously injures them, you may end up on the hook for their medical bills and lost wages if you didn’t purchase renters insurance.

In fact, a joint survey between the Insurance Information Institute and State Farm discovered that one-third of all homeowners insurance claims are made as a result of dog bites, and the average claim came out to roughly $35,000.

Renters Insurance Is Inexpensive

One of the main reasons people choose not to purchase renters insurance is because they believe it’s too expensive, but renters insurance is actually far more affordable than a homeowners insurance policy.

In fact, the average cost for renters insurance in North Charleston is just $23 per month! When considering the $30,000 or more it may cost you to recover from an apartment fire or pay the medical bills of someone who was injured in your home, it’s well worth the price.

So, how much coverage do you need? Most insurance companies recommend purchasing enough coverage to match the value of your belongings, plus $100,000 of personal liability in case someone files an injury claim or lawsuit against you.

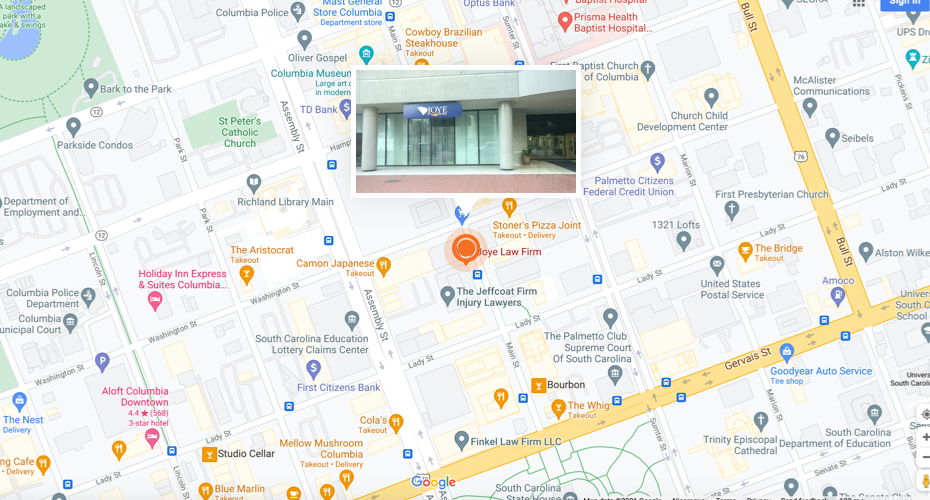

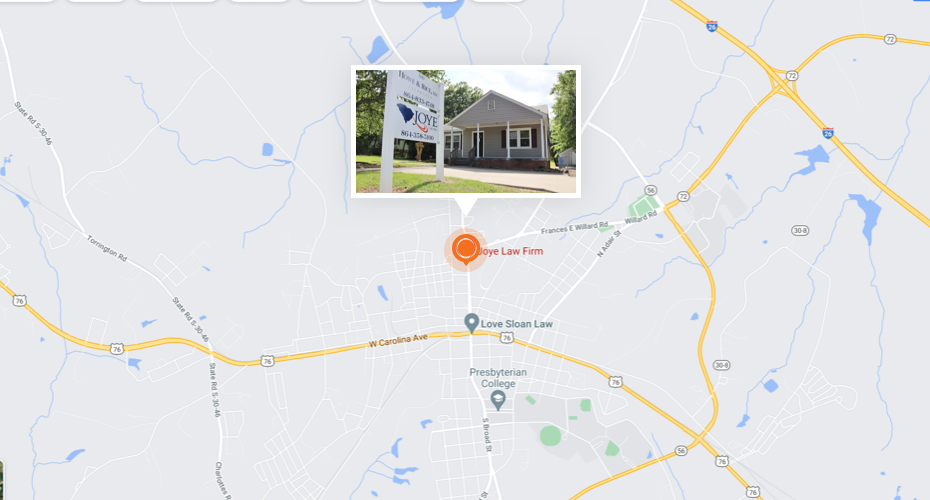

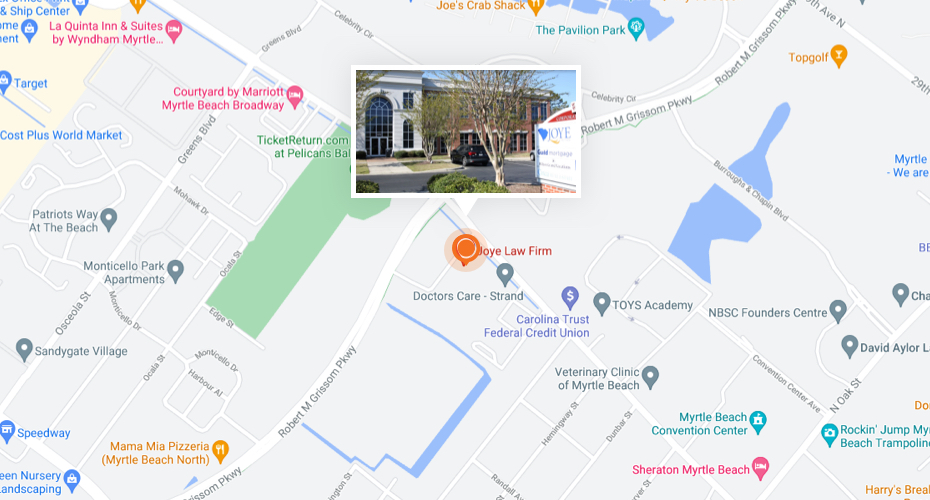

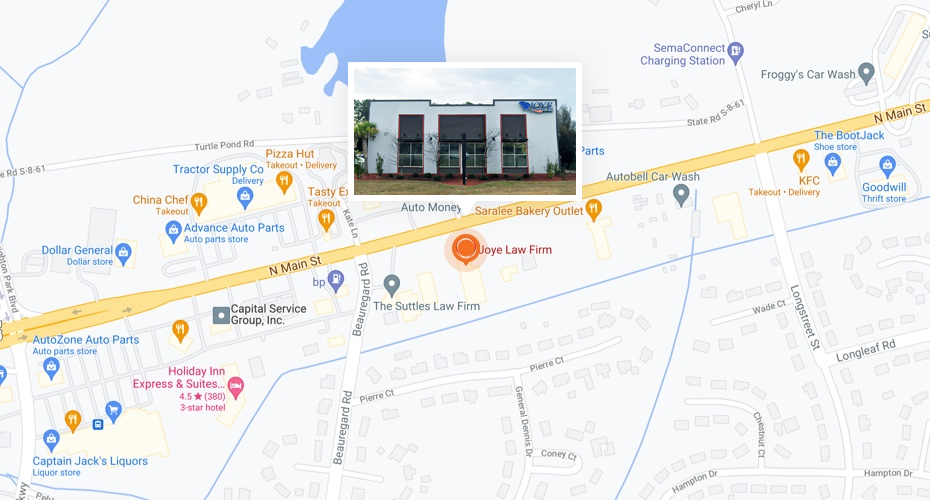

Joye Law Firm Is Here to Help

If you are dealing with a premises liability case, the South Carolina premises liability lawyers at Joye Law Firm can help. We can negotiate with your insurance company on your behalf regarding your claim, help protect your rights, and get you the full amount you are owed. Contact us today for a free, no-obligation case review to get started.