Even if you are an undocumented immigrant working in South Carolina, you have the same workers’ compensation rights as any legal citizen under SC state law. You may have a right to both medical and financial benefits if you are employed and sustained an injury while on the job, in the course and scope of your employment.

It is not uncommon for employers to try to deny workers’ compensation benefits to their injured employees to avoid higher insurance premiums.

Some employers may try to take advantage of a worker’s undocumented status to discourage the reporting of workplace accidents or to deny workplace injury benefits. An immigrant may not know their rights under South Carolina’s workers’ compensation law and may be afraid that a workers’ compensation claim would attract attention to their immigration status.

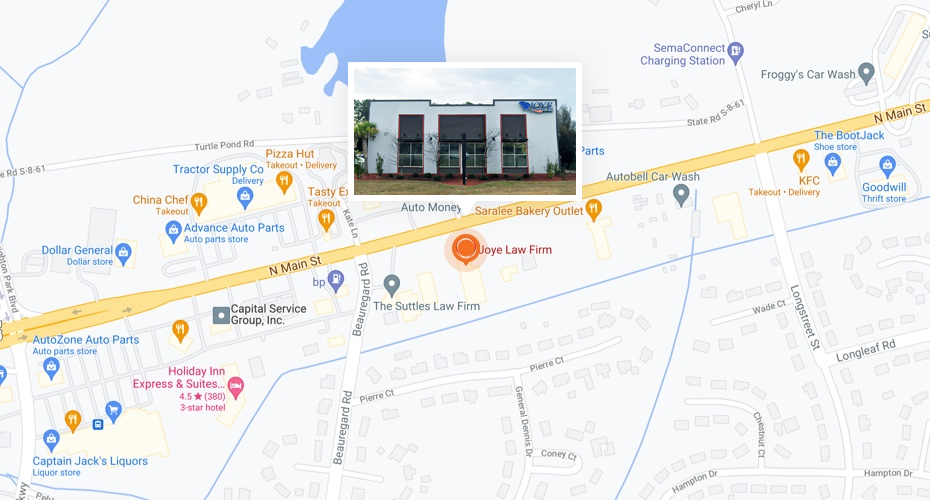

Our workers’ compensation attorneys at Joye Law Firm in North Charleston can advise you if you are an undocumented worker who has been injured or become ill while performing your job duties for a South Carolina employer.

If you were employed in South Carolina at the time of your injury – even if you were employed without proper paperwork – you are still protected by state law. Our workers’ compensation attorneys will work to help you pursue all the benefits that are available by law. We will not charge you a legal fee unless we are successful in securing workers’ compensation benefits for you.

Contact Joye Law Firm in North Charleston today for a free and confidential review of your injury and a discussion of your legal options.

Who Is Eligible for Workers’ Comp in South Carolina?

Under South Carolina law, most businesses operating in the state that have four or more regularly scheduled employees are required to carry workers’ compensation insurance for their employees. That includes full-time employees, part-time employees, and employed family members.

The law, at Section 42-1-130, states:

The term “employee” means every person engaged in an employment under any appointment, contract of hire, or apprenticeship, expressed or implied, oral or written, including aliens [undocumented immigrants] … whether lawfully or unlawfully employed.

However, there are exemptions in the law, including:

- Workers’ comp is not required for “casual” employees hired temporarily for tasks that are not part of the employer’s usual business, trade, profession, etc. For example, a retail store would not need to provide workers’ comp coverage to someone hired for landscaping work.

- Employers whose total annual payroll during the previous calendar year was less than $3,000, regardless of the number of employees, do not have to provide workers’ comp coverage.

Workers’ compensation coverage is not required for:

- Agricultural employees (farm workers)

- Individuals who sell agricultural products for a producer

- State and county fair association employees

- Railroad employees

- Federal employees

- Licensed real estate salespersons who work for licensed real estate brokers on a straight commission basis or as independent contractors

- Commercial truck drivers who own or lease their trucks and work as independent contractors

Independent Contractors and Workers’ Compensation Eligibility

Independent contractors are not employees. There is no requirement to provide workers’ compensation coverage for them.

An independent contractor is generally defined as someone who:

- Operates under specific terms of a contract, and

- Uses their own equipment and tools, and

- Sets their own work schedules and pay rates

However, if you work for a subcontractor, you are considered an employee of the general contractor on the job. The general contractor must either provide workers’ comp for their subcontractors’ personnel or may require their subcontractors to maintain workers’ compensation insurance to work on their jobs.

If you are paid as an independent contractor, you may in some cases still be eligible for workers’ compensation. The IRS 1099 Form is typically used to pay independent contractors (non-employees) because it allows pay without withholding taxes.

However, the method of payment to workers is not the only determining factor as to the employer’s obligation to provide workers’ compensation insurance benefits. It is possible for an employer to pay a worker as a “1099 worker” and still be required to provide workers’ compensation insurance coverage.

Some unscrupulous employers misclassify their workers as independent contractors to avoid providing workers’ comp benefits and paying payroll taxes.

There are several specific tests to determine whether a worker is improperly classified as an independent contractor. An experienced worker’s compensation attorney at Joye Law Firm can assist you in determining your employment status if this affects your eligibility for workers’ compensation benefits.

What Workers’ Compensation Covers for Immigrants Who Are Hurt at Work

An employee qualifies for workers’ compensation benefits if he or she is injured while performing job-related duties and is temporarily or permanently disabled. In other words, workers’ comp is available if you have been injured while working, regardless of whether or not your miss time from work as a result of the injury. Workers’ comp is also available in cases of job-related illnesses that arise from your employment.

An employee qualifies for workers’ compensation benefits if he or she is injured while performing job-related duties and is temporarily or permanently disabled. In other words, workers’ comp is available if you have been injured while working, regardless of whether or not your miss time from work as a result of the injury. Workers’ comp is also available in cases of job-related illnesses that arise from your employment.

Workers’ compensation is a no-fault system. Even if the employee was at fault, the employee is still eligible to receive benefits for a qualifying injury. This does not include injuries caused by horseplay, fighting, or being intoxicated while on the job because these actions are not part of the employee’s job.

Injuries that occur while commuting to or from a job site or while away from the workplace for lunch may not be covered because the employee was not engaged in job duties at the time. But if driving is part of the job, an injury suffered during the drive may be covered.

South Carolina workers’ compensation benefits include:

- Medical Care. Workers’ compensation generally covers the costs of an injured employee’s necessary medical treatment for a qualifying injury or illness. This includes emergency care, hospitalization, doctor visits, medication, and rehabilitation.

- Partial Wage Replacement. After an employee has missed seven days of work as a result of a work-related injury or illness, workers’ compensation provides income replacement benefits. Under South Carolina law, the weekly benefit equals two-thirds of the employee’s gross, pre-tax average weekly wage. For injuries arising on and after January 1, 2025, the maximum payment is $1,134.43. It was $1,093.67 for claims based on accidents or diagnoses in 2024.

- Disfigurement. If a workplace accident causes an employee serious scars or disfigurement on the head, neck, or other body part that is normally visible, the employee may be entitled to up to 50 weeks of compensation equal to two-thirds of the employee’s average weekly wage for the disfiguring injury.

- Long-term disability. In cases of total permanent disability, the injured worker may receive income replacement benefits equal to 66⅔% of the employee’s average weekly wage for up to 500 weeks. In cases of physical brain injury or paralysis (paraplegia, tetraplegia), the worker may be entitled to lifetime benefits.

- Death benefit. If an employee dies as a result of a workplace accident or from an occupational illness, dependent immediate family members may be eligible to receive a workers’ compensation death benefit. Death benefits are calculated at two-thirds of the deceased worker’s average weekly wage up to the maximum amount. They may be paid for up to 500 weeks. Workers’ compensation in South Carolina also pays up to $12,000 for funeral and burial benefits.

Filing for Workers’ Compensation in South Carolina

After suffering a workplace injury in South Carolina, you need to do two things right away:

- Get medical attention. Nothing is more important than your health. Dial 911 for emergency medical care after a workplace accident if necessary. Medical care documents your injury. Be sure to tell the doctor you were injured while on the job.

- Report your injury to your employer. Under South Carolina workers’ compensation law, you have an obligation to report your work injury to your employer within 90 days of the accident. Don’t delay. Report the injury to your supervisor as soon as you can and follow up with a written notification. If you fail to do so, you may lose out on your ability to seek benefits.

Once you have notified your employer, ask to be seen by the employer’s recommended medical professional for an evaluation and treatment. You need to do this even if you have already been treated.

Your employer should file for workers’ compensation benefits on your behalf. If your employer or another supervisor tries to talk you out of reporting your injury or claims that you cannot receive workers’ comp because of your immigration status, then you need to contact a lawyer immediately.

Contact a South Carolina Workers’ Compensation Attorney

Our North Charleston workers’ compensation attorneys at Joye Law Firm can help you understand your legal rights and the benefits that are available after a workplace injury. As an undocumented worker employed in South Carolina, you may be eligible for workers’ compensation benefits if you are injured or become ill because of your job duties.

If you have been injured on the job, you can get a free and totally confidential legal consultation with an experienced workers’ compensation attorney at Joye Law Firm in North Charleston today. We have successfully represented work injury victims throughout the state of South Carolina for more than 50 years. We can help you too. Contact us now at 888-324-3100 or online.